Capital Group: 2020 Mid Year Outlook

By info@landmarkwealthmgmt.com,

Filed under: Guest Articles

Comments: Comments Off on Capital Group: 2020 Mid Year Outlook

Filed under: Guest Articles

Comments: Comments Off on Capital Group: 2020 Mid Year Outlook

Filed under: Guest Articles

Comments: Comments Off on Russell Investments: Global Market Outlook Q3 Update

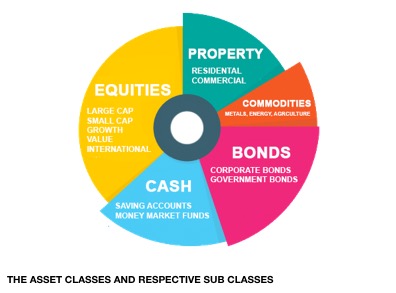

The concept of asset allocation was made famous by the economist and Nobel laureate Harry Markowitz and his introduction to Modern Portfolio Theory (MPT). The principle idea behind MPT in simple terms is the notion that an investor can maximize their returns within a given level of risk with the use of multiple asset classes. Under this premise, an investment is not evaluated on its own, but rather how it affects the overall portfolio when added to the other investments. One of the key variables is not just the historical performance of an investment, but how it correlates to the other investments in the portfolio. In lay terms, does the new added investment move in the same direction at the same time as the other components. Correlation is a mathematical measurement of how assets move. A correlation of 1.00 are two assets that move in perfect tandem. A correlation of 0.00 means when one asset increases, the other does nothing. A correlation of -1.00 are to assets that move precisely the opposite.

The lower the correlation, the less frequently the two assets move in tandem. A lower correlation is important, because as one investment does well, it offers the opportunity to do some profit taking, and add to another investment which is temporarily out of favor, also known as rebalancing. If an investor can maintain a lower correlation, they can produce more stability in their portfolio. This becomes extremely important when drawing an income stream from a portfolio.

One of the challenges in building a portfolio is that historical norms are not necessarily reflected in the shorter-term data. A quick look at the longer-term comparison of various areas of the market show that small cap and mid cap stocks outperform larger cap companies.

During the period of 1926-1983 the average returns were as follow:

Small Caps returned 17.05% with a Standard Deviation of 32.35%

Large Caps returned 11.26% with a Standard Deviation of 20.62%

Yet, from 1972-2019 the returns were less pronounced in favor of small caps:

Small Caps returned 15% with a Standard Deviation of 20.90%

Large Caps returned 13.2% with a Standard Deviation of 17.30%

The recent 10-year and 5-year returns through March 31st 2020 show the following:

Small Caps returned 8.02% over 10 years and 0.45% over 5 years.

Large Caps returned 10.44% over 10 years and 6.65% over 5 years

What can be seen in the recent data is US Large cap equities have produced higher returns with less volatility in recent years. This is especially true for the 5-10 year data, which ends in March of 2020, a period that was much more harsh for Small cap equities as the effects of the government lockdown took effect.

Yet, what we know is that current trends are not always indicative of the future. Other asset classes such as foreign equities have also underperformed US markets for some time. We have also seen the correlation between US and foreign equities rise. Over the last 10 years, the S&P 500 has maintained a high correlation with the MSCI EAFE index of about 0.85. While it’s reasonable to expect that with a much more global economy that is quite interconnected as compared to even 50 years ago, correlations will remain high. That does not necessarily mean that US market will consistently continue to outperform. They may or may not continue that trend.

We see from other asset classes like Real Estate Investment Trusts (REIT’s) that the correlations to the S&P 500 remain moderate. During the recent period of 1999-2019 the correlation between the S&P 500 index and REITs was about 0.65, while REITs returned 9.90% per year, making it an excellent diversifier.

One of the best diversifiers of risk remains investment grade bonds. During the last ten years, which has seen record low interest rates, the Barclays Aggregate Bond Index has returned 3.77% for the period ending March 31st 2020. However, the correlation between the investment grade bond market and the S&P 500 index has been a negative correlation of -0.22.

With each corresponding asset class, there is a trade-off of risk versus return. However, the data stills suggests that a diversified approach of incorporating all of these assets into one integrated portfolio will produce the least amount of volatility. Just as it is not prudent to attempt to guess when to get in or out of markets, it is also not wise to assume that you will know which are of the market will lead over the next decade. It may be time for Emerging Market equities to lead, or perhaps Developed International markets. If all of the recent new money creation leads to inflation, then Commodities would likely be a leader. Many believe that Small Cap equities are primed to lead over the next several years. Then there is always the endless debate of Value versus Growth companies. Asset classes are very much cyclical. Sometimes the cycle will last a few years. Sometimes for a decade or more. Since there is no plausible way to be certain, the principles of Modern Portfolio Theory still apply to any sound financial plan.

Filed under: Articles

Comments: Comments Off on Asset Class Diversification: Why it Matters

Landmark & Vanguard JT Presentation

Filed under: Guest Articles

Comments: Comments Off on Vanguard Presentation on Perspective and Current Market Situation

There are certain constants in life that we all assume as part of our day to day lives. Among them are death and taxes. We also presume that it will always be the case that 7 – 6 = 1. While this is true in math class, it is not always the case in financial planning. How can this be you might wonder?

The reason this is the case in financial planning is that investment returns are no lineal. Investors too commonly make the mistake of assuming that if they have an average return of 7% annually, that they can simply spend 6% of their assets, and they will continue to grow their principal by a factor of 1% per year. This may or may not be true depending on the timing of their investment returns. An average return is a set of randomized results that arrive at a longer-term average. If you arrive at an average return of 6%, it is often the case that you may not have had a single year in which you actually earned precisely 6% on your investments. As part of this long-term average, you will have negative and positive years mixed together. While markets are remarkably consistent over the longer term, they are highly unpredictable in the short term.

What happens if you happen to realize a significant number of those negative years early on as opposed to several years from now? While this is irrelevant if you are savings money for retirement for the next 25 years, it is extremely impactful if you are among the large number of retirees who use their investment portfolio as a source of income. Why does this matter? If you have an average return while saving money for 25 years, the result is identical regardless of when the returns occur. However, the moment you introduce withdrawals into the equation, the math changes dramatically.

Below is an example from a white paper done by Fidelity Investments several years ago. In this case:

Investor A and Investor B both begin with $100,000.

Investor A and Investor B both average a 6% annual return for 25 years.

Investor A and Investor B both withdraw $5,000 a year from their portfolio.

What you can see from the end result is that by year 20, investor A is completely out of money, while investor B has more than doubled their asset value by year 25. The difference is the sequence of returns. In this example, the annualized returns are simply reversed. Year 1 for investor A became year 25 for investor B, and vice versa. Simply reversing the order in which the returns took place produced a dramatically different result.

| Portfolio A | Portfolio B | |||

| Year | Return | Balance | Return | Balance |

| 0 | $100,000 | $100,000 | ||

| 1 | -15% | $80,750 | 22% | $115,900 |

| 2 | -4% | $72,720 | 8% | $119,772 |

| 3 | -10% | $60,948 | 30% | $149,204 |

| 4 | 8% | $60,424 | 7% | $154,298 |

| 5 | 12% | $62,075 | 18% | $176,171 |

| 6 | 10% | $62,782 | 9% | $186,577 |

| 7 | -7% | $53,737 | 28% | $232,418 |

| 8 | 4% | $50,687 | 14% | $259,257 |

| 9 | -12% | $40,204 | -9% | $231,374 |

| 10 | 13% | $39,781 | 16% | $262,594 |

| 11 | 7% | $37,216 | -6% | $242,138 |

| 12 | -10% | $28,994 | 17% | $277,452 |

| 13 | 19% | $28,553 | 19% | $324,217 |

| 14 | 17% | $27,557 | -10% | $287,296 |

| 15 | -6% | $21,204 | 7% | $302,056 |

| 16 | 16% | $18,796 | 13% | $335,674 |

| 17 | -9% | $12,555 | -12% | $290,993 |

| 18 | 14% | $8,612 | 4% | $297,433 |

| 19 | 28% | $4,624 | -7% | $271,962 |

| 20 | 9% | $0 | 10% | $293,658 |

| 21 | 18% | $0 | 12% | $323,297 |

| 22 | 7% | $0 | 8% | $343,761 |

| 23 | 30% | $0 | -10% | $304,885 |

| 24 | 8% | $0 | -4% | $287,890 |

| 25 | 22% | $0 | -15% | $240,456 |

| Average Return | 6% | 6% |

The next question is how do you defend against such a risk? The answer is rooted on two key variables, which are withdrawal rate, and asset allocation. It is not possible to time markets with any degree of consistency. As a result, neither you or your financial advisor have any real ability to control when such returns occur. The stock market is positive approximately 75% of the time, while the bond market is positive approximately 94% of the time. This data is remarkably consistent over the longer term as referenced earlier. However, because the short term is so unpredictable, no matter how well you design a portfolio, the sequence in which your average returns occur is little more than luck.

Numerous financial planning studies on withdrawal rates have demonstrated that if you plan to spend down assets from your investment portfolio as a source of income, then it important to limit that withdrawal rate to 4% annually. This assumes that you will increase spending over the course of your retirement with inflation, so the annual income is not level. Using such a 4% withdrawal rate, it is highly probable that you should be able to safely spend down your asset base over the course of 30 years with a 90% confidence rate. In fact, according to a study reported by Michael Kitces several years ago, 2/3rds of the time, at the end of 30 years you’ll have more money than you started with in year one. However, 1/3rd of the time you’ll have less positive results, but still not likely run out of money. In the above example, there is a 5% withdrawal rate ($5,000 per year from an initial balance of $100,000) being attempted. Yet, even with a 6% average return, the results for Investor A failed within 20 years. A 5% withdrawal rate is generally considered to be high for someone in the early stages of retirement, and not recommended.

All of the above data on withdrawal rates of 4% is premised on the notion that you maintain a consistent asset allocation that has a risk profile in the vicinity of 50% stock and 50% bonds to 60% stocks and 40% bonds. This presumes that you do this in a highly diversified way, rather than concentrate in a small group of stocks and bonds. This also presumes that you do not attempt to time markets, but rather maintain this risk profile through up and down markets. Introducing too much or too little exposure to the stock market can disrupt your ability to maintain a consistent withdrawal strategy.

As referenced above, a 4% withdrawal rate is generally considered to be a safe rate of withdrawal for a 30-year duration. If you are retiring at a traditional age 65, this should take you to age 95 years old. As financial planners, we generally plan to age 95, as it is not uncommon to live into your 90’s anymore. Average life expectancy is not a prudent measure to use, as this is often misleading due to skewed numbers from those people who die at very young ages due to accidents, drug abuse, suicides, etc. These tragedies bring down the average life expectancy. Looking at data from the actuarial society, the information suggests that a couple that reaches age 65 has a better than 75% chance that at least one of them will live into their 90’s.

In financial planning, all of the data around an individual scenario needs to be considered. In some cases, a retiree may wish to retiree much sooner than a traditional age, and this would likely require a lower withdrawal rate. In other cases, a retiree may wish to withdraw a higher percentage of assets in the early years of retirement, and then plan to greatly reduce their spending in latter years. In such cases, there are strategies that can be implemented to address both scenarios.

Financial planning is something that must be addressed at the individual level as each individuals circumstance is unique.

Filed under: Articles

Comments: Comments Off on Sequence of Returns: A Substantial Risk to Retirees

In the midst of the recent market volatility related to the global shutdown due to corona virus, investors often become understandably emotional. Unfortunately, emotional responses are never wise when it comes to making financial decisions. This is especially true as it pertains to your investment portfolio. However, we think it’s important to address some of these concerns that investors often have during such events, which are often based entirely on emotion rather than data and what is actually happening.

“This is just gambling”

One such concern is the notion that an investment portfolio is little more than gambling in a casino. While this may seem so to the novice investor, it is in fact precisely the opposite.

When you enter a casino to play a game of chance, you may very well get lucky and win money in the short term. However, if you choose to stay there long enough, you will eventually lose. The reason is simple enough. The odds are mathematically against you. The odds are always in the house’s favor, making a stay at a casino little more than entertainment.

Investing is precisely the opposite. When you build an investment portfolio, you essentially become “The House”. While you may have a bad couple of months, or even a year or so, the odds are always in your favor. The longer you are invested, the better your odds become. This presumes, that you are not trying to time markets and trade in and out of them, which is not a strategy we would never endorse, as it has no historical track record for continued success.

What makes you “The House”?

Ultimately, people are still going to buy food, cleaning supplies, cars, houses, new computers, etc. As a result, companies such as Clorox will continue to sell bleach, companies like Home Depot will continue to sell plywood, and companies like Apple will continue to sell phones, just to name a few. As an investor, you represent a stake in all of these companies as part of a diversified portfolio. And while the names of who sells what products will change over time, as long as you have a broadly diversified portfolio, you will have a stake in most all of them. While this particular crisis has presented a sudden government induced shock to demand, it is not realistic to presume that the consumer will never buy anything ever again from you. Yes, that means you, the owner of these various businesses you maintain stakes in as the investor.

This is precisely why markets always recover from these types of sudden shocks, and often fairly quickly, only to set new highs. Because ultimately, we still need to buy things, even if the government has forced us to delay them for a couple of months for the sake of protecting the health of the global population.

What if I lose everything?

This is another concern or question we have received many times over the combined 80 plus years of experience that our firm’s members have had. While we are sympathetic to the concerns and fears investors have, this is a fear that is founded 100% in emotion, and not in reality when applying a properly diversified investment portfolio.

If you were to invest in just a select few companies, then this can in fact happen. Any individual company can most certainly go bankrupt. While we can’t say for sure which companies will be bankrupted as a result of this particular crisis, we are fairly certain some business entities will unfortunately fail.

However, in a diversified portfolio, we have created exposure to virtually the entire global public market with different proportional exposure to each area. Our portfolios are built primarily with various ETF’s and mutual funds that represent broad market indices with more than 7000 global companies, and 12,000-15,000 fixed income holdings. As a result, in order for a portfolio to “lose everything”, you would effectively have to see virtually every public company and government on earth fail.

If such an implausible scenario were to play out, then it really doesn’t matter what you did with your money. The dollars you have only retain their value because they are backed by the taxing power of the United States government. If every company were to fail, then there are no longer any businesses or employees receiving salaries left to tax, which would render your dollars worthless. There wouldn’t be anyone producing anything for you to buy. Nor would there be a bank to hold your money, or an FDIC left to file your claim for your lost funds.

So, while we don’t subscribe to any such doomsday like scenarios, if you follow such fears through to a rational conclusion, it becomes clear that in such a doomsday scenario, it wouldn’t matter if you had your funds invested or not. It wouldn’t matter if you had $1,000 or $100 million. Money would become effectively worthless paper.

So rather than focus on such implausible and unrealistic types of scenarios, we think its more productive to focus on history. History tells us that these events are little more than a short-term bump in the road. These types of declines tend to be short lived, and with the use of a proper asset allocation, it typically doesn’t take that long to return to your previous peak before you begin to see new highs.

In order for this to be short lived, there is a process that must be followed as it pertains to asset allocation. If your portfolio was targeted to maintain 60% stock market exposure, and 40% bond market exposure based on the financial plans you hopefully addressed in advance, then you must maintain this allocation. That means you must be disciplined enough to take some profits in years like 2019 when equity markets outperformed substantially. Equally important is the need to sell some of your fixed income holdings and buy into these declines as markets are declining. All of this is designed to maintain a consistent risk profile by forcing you to sell high and buy low.

Since markets are unpredictable in the short term, it is not realistic to pick a precise top or bottom to the market, as there are too many variables that impact this vast economic ecosystem. Rebalancing a portfolio back to your original target risk profile is a systematic and mathematical way to consistently sell high and buy low. They key reason this works overtime is the fact that it is mathematical, and not emotional. However, in order to apply this approach, you must be unemotional in your application of asset allocation and rebalancing. This is easier said then done. As the old saying goes “the stock market is the only place that nobody wants to buy when it’s on sale”.

Unfortunately, studies show that the average investor is not terribly good at removing emotion from the decision making process. DALBAR, which is an independent organization that studies such investor behavior has consistently found that retail investors dramatically underperform the broad markets over the longer term. The reasons have little to do with the investments they choose to buy, and more to do with the timing of when they choose to sell or buy, which is too often based on fear or irrational exuberance.

As practitioners of these asset allocation principles, we are completely unemotional in our application of risk, and the need to consistently rebalance back to an original target risk profile in a client’s portfolio, regardless of market conditions. We maintain a steady hand, because we simply know that over time, the math works. Emotional responses can do an enormous amount of long-term damage to a financial plan that will ultimately lock in losses. If you have an asset allocation based on a financial plan, that plan should have already accounted for the eventuality of a substantive market decline. Such events are not a question of “if”, but rather “when” it happens. Such events should be viewed as an opportunity, not a reason to panic.

Filed under: Articles

Comments: Comments Off on The Greatest Risk to Investment Success: Emotional Reactions

Filed under: Guest Articles

Comments: Comments Off on Russell Investments: Global Market Outlook – Q2 Update

https://amgfunds.com/content/dam/amgfunds/LandingPages/KeepCalm/per_keepcalm_per029.pdf

Filed under: Guest Articles

Comments: Comments Off on Keep Calm and Remain Diversified

As investors work their way through the latest round of market volatility, this time driven by the recent fear of the “Corona Virus”, a number of fears often arise from investors. Questions such as:

Is it different this time?

Do I have time to recover now that I’m retired?

How long does it take to make my money back?

These are common questions which are not unique to this particular market downturn. And each one has an answer.

Is it different this time?

The answer is a resounding YES! It is always different. However, as Sir John Templeton said, the four most dangerous words in investing are “this time it’s different”. Each market correction and bear market is driven and preceded by a different series of events. The 1920/21 crash, the crash of 1929, the Stagflation of the 1970’s, Black Monday 1987, the tech wreck of 2000, 2008 financial crisis, or the Ebola scare of 2014.

Such events have in some instances led to a recession, and some were a mere short-term downturn. Yet, it is always different. Different does not necessarily imply it is worse. Different does not by any means suggest markets won’t recover. Ultimately, the stock market is little more than a collection of many different businesses. The longer-term price of a stock is dictated by profits. How profitable a company is and is expected to be in the future will determine the company’s stock price. While an individual company can certainly fail, over the long term, markets as a whole will continue to grow profits given enough time. As a result, markets continue to grind higher given enough time.

Do I have time to recover now that I am retired?

The answer to this is typically yes. It’s important to remember that retirement does not mean that you are going to spend all of your money on day one of retirement. If that were the case, then market volatility would be the least of your concerns. A typical retiree in their mid-60’s may very well live into their 90’s. As a result, we generally suggest projecting a financial plan to as old as age 95. If you entered the labor force at age 21 and retired at 65, that’s 44 years you have been saving for retirement. However, you may very well live another 30 years in retirement. Over that time, you may see a significant amount of erosion of your purchasing power via inflation. Presuming that you are spending through assets at a reasonable pace, and also using a well-diversified balanced portfolio, you not only have time to recover…but will see many market corrections and several bear markets over that time period.

How long does it take to make my money back?

The answer to this depends on the degree of portfolio risk you introduce. An investment portfolio that is 100% in the stock market would inherently take on more risk, and likely higher longer-term returns. However, having 100% of your portfolio in stocks is typically not prudent for most retirees, or most investors in general. Particularly if there is an income need at hand. As a result, it is more practical to look at a more common allocation seen by the typical investor entering retirement.

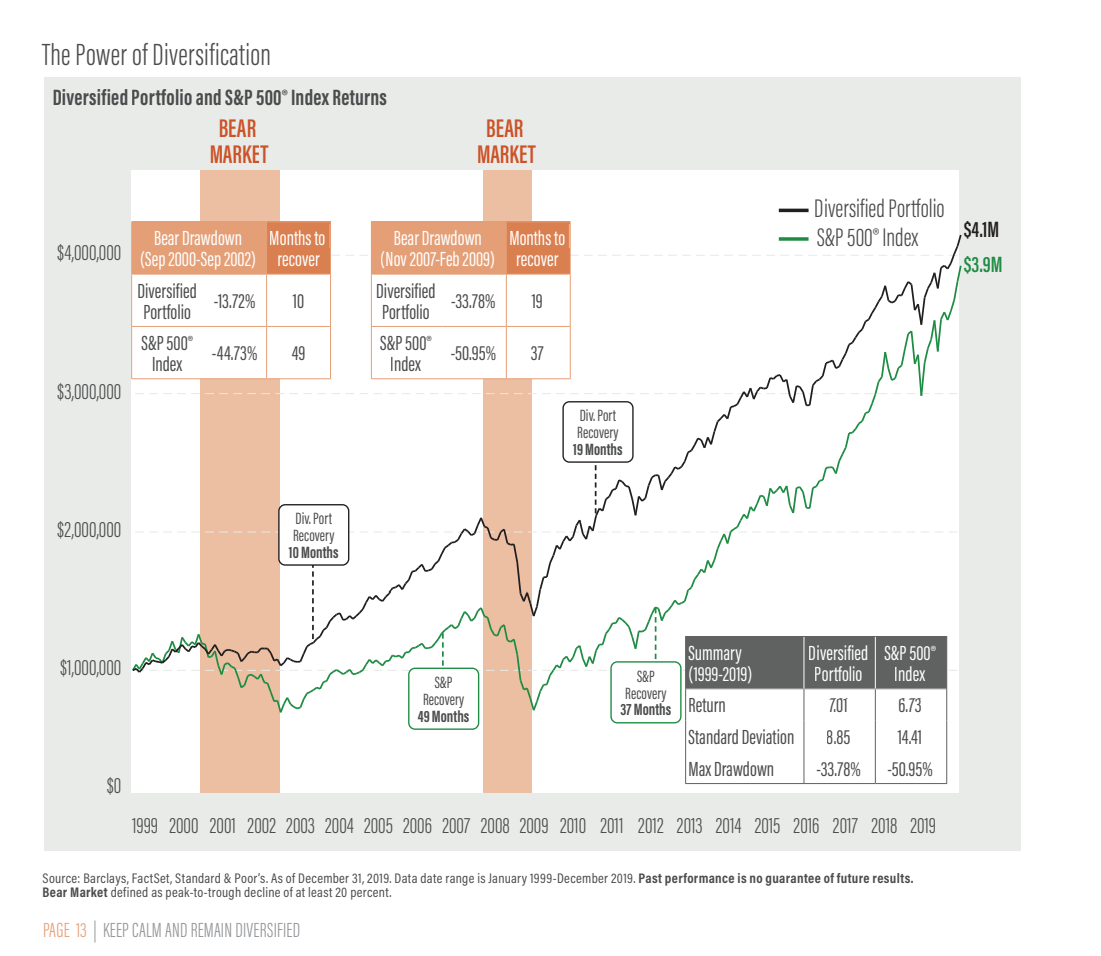

An investor that has a diversified asset allocation that allocates 60% of a portfolio to stocks, and 40% to fixed income investments is one of the most common allocations seen by the typical retiree looking to draw an income over a 30-year period. We call this a balanced allocation. So, what can you expect with such an allocation? The chart above provided by AMG gives some historical perspective on the impact of substantive market declines.

Looking at the 2008 financial crisis, which was one of the worst in market history (beginning in October of 2007 through March of 2009), a balanced portfolio would have taken approximately 19 months to return to its prior peak value from the bottom of the markets. In terms of its impact on a financial plan, this was very manageable.

During the 2000 technology bubble implosion, compounded by the September 11th attacks of 2001, (beginning in September 2000 through September 2002), US markets saw three consecutive negative years, which is relatively rare. Yet, it took only 10 months for a balanced portfolio to recover from the bottom of 2002. Also quite manageable.

In each instance, for a portfolio that was 100% in stocks, it took significantly longer to reach the previous peak. That was approximately 37months after the financial crisis and 49 months after the bursting of the technology bubble/9-11 attacks. This data lends itself to the importance of having the correct asset allocation that matches your risk tolerance an income needs, as opposed to putting all your money in stocks, or any individual company.

Remember that a loss of -10% requires an 11% return to breakeven. Steeper losses, such as a -40% decline requires a return of 67% to breakeven. A -50% loss requires a return of 100% to breakeven.

Additionally, this data also presumes that an investor stays invested all the way though these periods without attempting to time market movements, or selling out of fear and panic. Staying invested all the way through is vital to your success as an investor. Looking at the S&P 500, simply missing just the best 25 days over the course of the last 20 years is the difference between having a consistent return, and actually producing a net negative return over 20 years.

All of this data demonstrates that it pays to stick to the plan. Yes, this time is different. But so will next time, and the time after that. Yet, each new market bottom is consistently higher than the previous bottom, and each new peak is higher than the previous peak…as markets continue to grind higher over the long term. While history does not repeat itself precisely, history is an excellent guide for investors.

Filed under: Articles

Comments: Comments Off on Market Corrections: How Much Impact Do They Have?

On December 20th President Trump signed into law the SECURE ACT, a bill which received a significant amount of bipartisan support in the United States Congress. The new legislation makes some significant changes that impact retirement plans for all Americans. Like all legislation, there will be pros and cons, and ultimately it will have some yet to be realized unintended consequences.

Among the more positive aspects to the new legislation, the following changes have been made:

IRA contributions for those that still have earned income will no longer be capped at age 70 ½. The age restriction has been lifted. If you or your spouse are still working, you can contribute to either a Traditional or Roth IRA.

Required Minimum Distributions (RMD’s) will no longer be mandated at age 70 ½. The new requirement for the RMD to begin is age 72. This is an advantage to those who were drawing an income from their retirement accounts only because it was mandated and had no need for the income. The new rules will permit individuals the extra time for tax deferral. It should be noted that the investors who were already subject to the RMD and had begun the income in the year prior will not get the delay. If you have already begun your RMD, you must continue to take it.

401k access will be expanded to more part time employees of corporations, as well as allowing small business owners to auto enroll participants, and even gives a tax incentive in the form of a $5,000 tax credit for doing so. Additionally, beginning in 2021, business owners from totally unrelated industries will have the ability to pool their resources together to form an employer-based savings plan.

Penalty free IRA withdrawals can now be taken up to the amount of $5,000 for the purpose of childbirth or adopting a child.

529 college savings plans will now permit students to withdraw as much as $10,000 over the their lifetime to cover the cost of student loans, as well as apprenticeship programs.

Graduate or post-doctoral students receiving income in the form of a fellowship or stipend can now treat these benefits as earned income for the purpose of making a retirement contribution.

The one Very Big negative as it pertains to this new legislation is the elimination of what is know as the “Stretch Benefit”. This is a benefit afforded to the beneficiary of a qualified retirement plan or IRA that inherits the plan from a non-spouse. When a spouse inherits such a plan, they can simply transfer the balance of the account to their own IRA as if it was theirs all along, with no differing treatment in the application of the rules. However, since the tax act of 2001, non-spousal beneficiaries have been permitted to withdraw the asset over their actuarial assumed life expectancy, which minimized the tax impact to the beneficiary.

Under the new rules, the balance of the account must be liquidated within a period of ten years. The beneficiary will have the option of spreading the income out over the ten-year span, taking it all in one year, or in any sequence they wish. As long as they have withdrawn all the assets within the ten-year time frame, they have met the requirement. Regardless of how they take the income, the disbursements are treated as ordinary income from a traditional IRA or retirement plan, which greatly accelerates the tax liability along with the income.

A key aspect that should be noted is that the beneficiaries who have inherited these accounts from a decedent that has passed away prior to 2020 will be grandfathered into the old rules and still enjoy the stretch benefits for the duration of their lives. Additionally, stretch benefits remain in effect for a beneficiary that is a minor, less than 10 years younger than the decedent, or one that is disabled.

Because of the accelerated tax impact on beneficiaries, the case for doing Roth IRA conversions will be stronger in many scenarios. Many retirees who do not need the income may now find it more prudent to convert a portion of their retirement accounts annually while they are retired and possibly in a lower tax bracket then that which their adult children may be subject to when they inherit these assets, which is commonly during their prime earning years.

As with any change in the tax code, this will impact some investors differently than others, and some not at all. At Landmark, we believe this is something that should be addressed collectively with your financial advisor, tax advisor and estate planning attorney.

Filed under: Articles

Comments: Comments Off on The SECURE ACT: How it May Impact You