I-Bonds: What Are They, And Do They Make Sense?

By info@landmarkwealthmgmt.com,

Considering the recent high inflation environment where the March 2022 CPI figure was 8.5%, and in 2021 the average inflation was 4.7%, savers have rightfully so been looking for a safe place to put their money where its purchasing power doesn’t get eroded from the effects of inflation. To make matters worse, savings rates on money markets and 1 year CD’s are 0.60% and 1.35% respectively, meaning savers are losing purchasing power after inflation is taken into consideration. There are other options of course that historically have kept up with inflation but it comes with additional risks, such as stocks, commodities or real estate. So, what is a conservative saver to do?

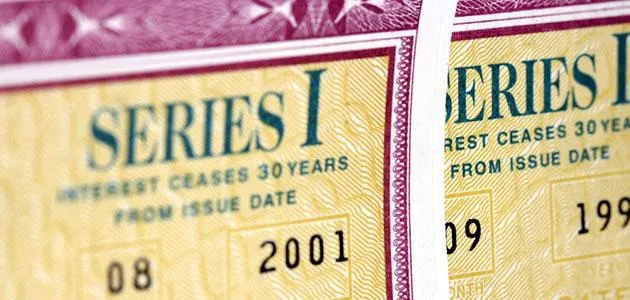

One option that has recently been in the headlines are Treasury Savings Bonds called Inflation Bonds (I Bonds). I The recent attention is a result of the current interest rate paying 9.62%! So, what are I Bonds? Think of savings bonds that you would get for a birthday or a holiday gift which you buy at half the face value, and they mature at face value at some future date. They were issued in series such as Series E or EE bonds, which was on the front of the bond. Many of us still have them in the safe deposit box.

I Bonds by comparison were created by the Treasury Department back in 1998 to help savers keep up with inflation. The Series E or Series H savings bonds accrue at a fixed interest rate. Therefore, if we have high inflation, the purchasing power of your savings is eroded if the inflation rate is higher than the fixed rate. I Bonds were designed to have an interest accrual adjustment as well which is explained below. Due to the fact that they are issued by the government they are safe, with interest and principal guaranteed by the United States. They have a 30-year maturity, after that, they stop accruing interest.

Bonds can be bought at TreasuryDirect.gov or using your Federal Tax Return. When bought online, they are electronically held at the Treasury. The minimum purchase starts at $25. You can buy in any dollar increment right down to the penny. They are issued in paper if you buy them through your federal tax return. You can buy them by filing Form 8888 along with your return and the refund will be used to purchase the paper bond. The remaining portion of your refund will be sent to you. The paper bond is sold in denominations of $50, $100, $200, $500 or $1,000.

The rate of an I bond is composed of two parts, the fixed part and the variable part. The fixed rate is determined at the time of purchase and remains the same throughout the life of the bond. The fixed rate on new bonds is determined by the Treasury every six months, which is based upon their borrowing needs and current market rates. The second part, the variable rate is based upon the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U), including food and energy. The rate is set every 6 months on the first business day of May and November. The change is applied to your bond on the bonds issue date. If you bought a bond in January, then the change is reflected in January, not November and then runs for 6 months. The interest is earned every month and accrued every six months. Therefore, the interest accrued from the past 6 months is added to the bond and you start earning interest on the prior months interest. The principal and interest are paid to you when you cash in your bond.

Currently, the fixed rate is 0.00% but the current variable inflation accrual rate for May of 2022 through October 2022 is 9.62%! That has been the recent attraction to these type of savings vehicles because of the high accrual rate. There are caveats one should consider before going out and buying I Bonds for your portfolio.

First, there is a maximum purchase amount that they Treasury allows, which is $10,000 per calendar year. You can buy an additional $5,000 per year via your Federal Tax Return. If you wish to buy them on behalf of others, there is no maximum number of people for whom you can do this. For example, if you want to buy for multiple grandkids, you can purchase $10,000 for each grandchild, and an additional $5000 per grandchild via your tax return. The owner is determined when you buy them and who they are registered for, such as a grandchild.

Next, as noted earlier, I Bonds have a 30-year maturity, so they stop earning interest after 30 years. However, you can cash in your bonds after one year. It’s important to note, if you cash in your bond before 5 years, you will have a penalty of the last 3 months of interest. Given the one-year hold requirement and five-year interest penalty, buying savings bonds should be thought of as longer-term commitment as opposed to putting your emergency fund into I Bonds.

Taxes are due on the interest when the bonds are cashed in. They are federally taxable but state and local tax free. The tax form, which is a 1099 will be sent to you from the institution you cashed them in with. If you redeemed them through Treasury Retail Services, they would issue the 1099. If you redeemed them through a financial institution, they would issue the same tax document.

There are additional considerations when thinking of adding I bonds to your holdings such as the opportunity costs. Recall that the fixed rate is currently zero. Before the recent inflationary environment, rates and inflation for the past decade had been very low. This meant that the rate was zero on the fixed rate as well as the variable inflation rate. Should inflation moderate, it’s possible that you could have a much lower rate of return. As a result, you should consider what other options may provide a better overall return during the duration of time you plan to commit your money.

As you can see, there are several considerations to make before adding I bonds to your savings strategy. As always, diversification is key to a well-constructed investment strategy. If I Bonds make sense for you then they can serve as another conservative portion of an overall financial planning strategy. If you have additional questions, feel free to reach out us to see if you should consider I Bonds for your financial plan.

The best place for additional information is TreasuryDirect.gov which provides FAQ’s on I Bonds and other government debt instruments.

Filed under: Articles

Comments: Comments Off on I-Bonds: What Are They, And Do They Make Sense?