Market Volatility: Friend or Foe?

Market volatility is not something that investors enjoy, as none of us like to see our assets decline, even if it is for just a brief period of time. However, volatility is inevitable and must be dealt with to be a successful investor.

When investing for the future, most investors use some form of retirement plan for tax advantages, while others save independently in after tax accounts. However, while we save for the future, most often we are consistently peeling off a percentage of our earnings to allocate towards future goals. Since most Americans are paid either weekly or bi-weekly, we slowly allocate a percentage of this in what is known as dollar cost averaging.

Dollar cost averaging is a strategy whereby an investor contributes a set dollar amount or percentage over a time frame to their investments. Most of the time, dollar cost averaging happens because you are simply not in a position to invest all of the money at one time, as your employer is not going to pay you your compensation for the next 30 years in advance. However, in some cases investors do come into a large lump sum of money for various reasons, and they have a choice to make. Should they invest all of the cash at one time, or dollar cost average over a period of time. After all, committing a large amount of money at once just to see it immediately decline, in some cases substantially, can be rather distressing.

Fortunately, there is some data on which works better. Vanguard completed a study on this very topic which revealed that 2/3rds of the time the lump sum investment outperforms, while 1/3rd of the time dollar cost averaging yielded better results. The same study demonstrated that the longer the period of dollar cost averaging, the more it favored the lump sum. The reason for this is because historically markets are positive roughly 75% of the time, so the longer you wait, the more likely you are to be paying more for the same investments in the future.

Nevertheless, in the case of the typical 401k investor that is consistently deferring money from their paycheck for their future retirement, dollar cost averaging is the only choice. Yet, during periods of volatility, you may benefit from the market chaos.

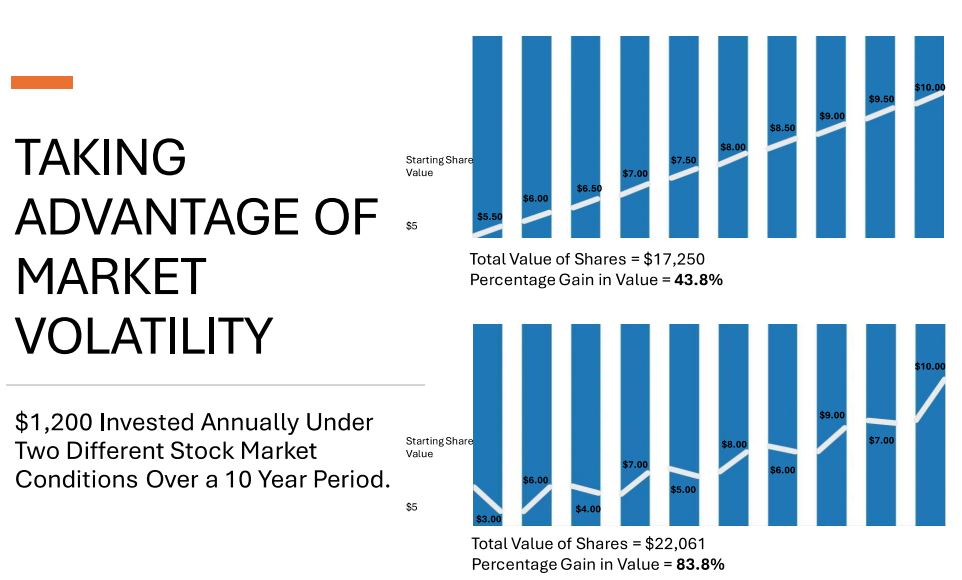

As illustrated in the image above, when we look at two contrasting scenarios in which each investor invests $1,200 annually starting at $5 per share and finishing at $10 per share over a 10-year period, we see different results.

The first investor saw a steady increase annually in their investment, and likely realized much less stress as their investment consistently increased with no volatility whatsoever, yet the paid more for each subsequent investment.

While the second investor saw choppier markets with periodic volatility causing annual investments to take place in both positive and negative years. This helped to bring their average cost down.

The results demonstrate the following:

Investor 1- Initial Investment – $12,000

$17,250 final market value and a cumulative return of 43.80%.

Investor 2- Initial Investment – $12,000

$22,061 final market value and a cumulative return of 83.80%.

It’s important to keep in mind that the first scenario of markets consistently rising with no downturns is almost certain not to happen. While volatility can be mild or extreme at different points in time, a good investor will stay the course. What this demonstrates is that while markets decline and volatility is not enjoyable in the moment that they happen, if you are disciplined and consistent investor, you can use this to your advantage.