Vanguard Economic and Market Outlook for 2022

By lwmdemo4,

Vanguard Economic and Market Outlook for 2022

Filed under: Guest Articles

Comments: Comments Off on Vanguard Economic and Market Outlook for 2022

Vanguard Economic and Market Outlook for 2022

Filed under: Guest Articles

Comments: Comments Off on Vanguard Economic and Market Outlook for 2022

Russell Investments 2022 Global Market Outlook

Filed under: Guest Articles

Comments: Comments Off on Russell Investments – Global Market Outlook 2022

In February of 2015, we wrote an article about the topic of inflation that tried to address not only some of the concerns about inflation, but also some of the confusing and seemingly misleading inflation data. Particularly, how the measures of inflation have changed over the years to reflect what may be a very inaccurate picture for a large number of Americans.

Let’s start with a little history. Inflation measures were traditionally designed to measure a constant standard of living. This was done by observing a fixed basket of goods and measuring the price changes without materially altering their weighting. In fact, prior to 1945, what we now call the Consumer Price Index (CPI) was actually known as the Cost of Living Index.

However, this concept evolved in academia to measure a constant level of satisfaction. The idea was that the changing relative costs of goods would lead consumers to substitute less-expensive goods in place of more-expensive goods. If such a substitution of goods was allowed for within what was once a model of a fixed-basket of goods, the maximization of the “utility” of money held by consumers would allow for the attainment of “constant level of satisfaction” for the consumer. These types of geometric weightings are now the method of choice.

In more simple terms, if consumers were once eating steak three nights a week, but the cost of steak has grown, and they are now relegated to buying a less expensive set of goods such as pasta, then pasta would increase in the weighting of the CPI since it is more actively consumed. This is essentially how CPI is calculated today. The more something is consumed, the bigger weighting it will eventually have. This was seemingly viewed as a positive change in academia as the presumption is that the level of satisfaction is the same because a less expensive product is being used to meet the same need and expanding the “utility” of money.

The utility of money is defined as “the satisfaction of or benefit derived by consuming a product”. These types of interpretations may seem quite nebulous to the layperson. In the example above, there may be some people who are just as satisfied by eating less expensive pasta rather than spending their money on steak, while others may not be so pleased by this outcome, and don’t particularly like pasta. It is for that reason that we would argue that some of the inflation data is misleading versus the real-world experience.

Recently the Bureau of Labor and Statistics announced that beginning in January 2022 it will be changing the weightings in the Consumer Price Index to reflect the 2019/2020 consumption expenditure data.

Many changes have been made to the methods of calculating inflation over the decades. Economist and economic consultant Walter J. Williams has written about this for years. Using his inflation models, he contends that if we were to use the same formula that was used in 1990, the rate of inflation is in excess of 10% as of November 2021. He also has models using the 1980 based methodology which places current inflation closer to 15%. Perhaps, the new models are more accurate. That would then by process of elimination mean that the higher inflation seen in the late 1970’s to the early 1980’s was not as bad as we thought. However, we think those who lived through that period would likely disagree.

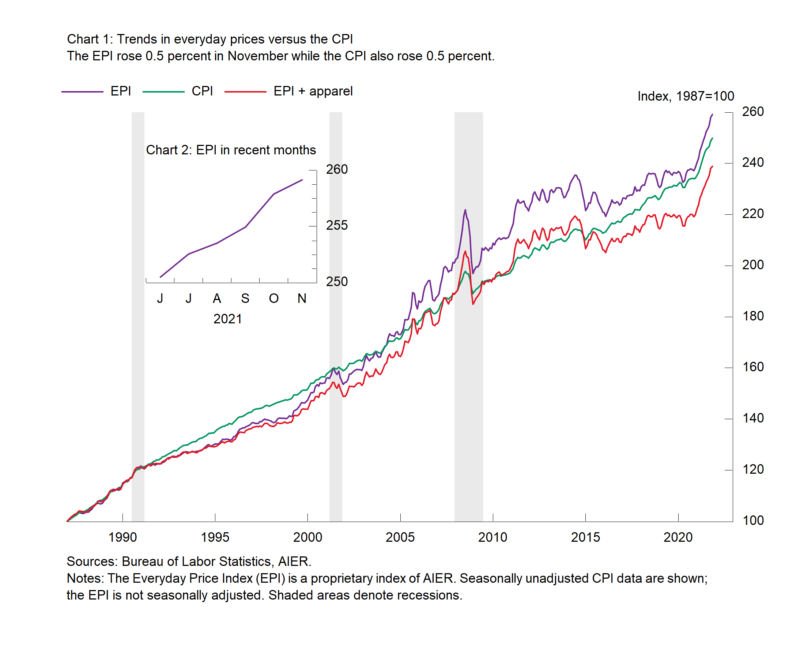

The American Institute for Economic Research maintains an inflation calculation created by two economists, Polina Vlasenko and Steven R. Cunningham, called the Everyday Price Index (EPI) which is designed to look closer at the consumers reality. The premise is that they essentially place heavier weightings on the items that are purchased more frequently, such as grocery shopping, and less of a weighting on items that are bought less frequently, such as a new television. As seen in the above chart, through November of 2021 the EPI was at 9.3% versus the governments CPI data of 6.8%.

Another change that has resulted in a significant difference in the way inflation was calculated in the 1980’s data versus today, is housing. House price inflation was included as a metric then, while today it is not. As Joseph Carson, the former Chief Economist for Alliance Bernstein recently noted this past July 2021:

“Here’s a simple illustration of how significant including and not including house price inflation can be. In 1979, CPI rose 11.3%, and that included a 14% increase in the price of existing homes. In the past twelve months, CPI has increased 5.4%, and the 23% increase in existing home prices is not part of that. Government statisticians have created an arbitrary owner rent index (up 2.3% in the past year) to replace house prices.”

The case for not including housing was that it is a long-lived asset that the consumer will consume for a series of years or perhaps decades. Yet, while home prices are excluded, short lived items like food and energy are also excluded from the Core CPI. Meanwhile used car and truck prices, which can have a ten-year life span have a 3% weight to the CPI. If you are a potential new home buyer, this may seem somewhat disconnected from reality.

Another variable in the CPI data is that there is more than one version of the CPI. CPI-U measures the rates of inflation for urban areas, and CPI-W measures the inflation rate for clerical workers. These two are used to determine the annual increase in Social Security payments. One of the most commonly quoted measures of inflation is called the “Core CPI” which excludes the impact of food and energy products, which explains a good degree of the discrepancy between the CPI and Everyday Price Index (EPI). The premise for excluding them is that food and energy are extremely volatile and don’t represent the true picture of aggregate economic demand. Unfortunately, people still need to eat, heat their homes in the winter and fill up their gas tanks. As a result, it’s not too difficult to see why many people still believe that inflation data, which has been on the rise still doesn’t represent their real-life experience.

Hedonic adjustments are another aspect of how inflation data can be misleading. Hedonic adjustments attempt to measure the quality changes in a product or service. Imagine if a new computer increases in price by 5%, and the computer was exactly the same, that would mean it reflects inflation of 5%. However, if the quality of the computer has changed, and you are paying 5% more in price for a computer that has 10% more capability, then a hedonic adjustment may assume that the computer is selling for 5% less because you are getting more for your money, even though you spent 5% more in price. While in some cases this can make sense, what if the new added capability is of zero use to you, but that is all that is available in the marketplace? Have you really seen a reduction in price? Not necessarily. However, in the eyes if the Bureau of Labor and Statistics (BLS), that can be a reduction in cost via a hedonic adjustment. We see positive and negative adjustments all around us. The question is whether the BLS captures all of the boxes of cereal that sell for the same price, but now have a smaller box? This seems unlikely. It sometimes seems as though they capture the positively impactful adjustments whether they are relevant or not, and miss some of the negatively impactful adjustments.

At this point in time there are several drivers of inflation. Supply chain disruptions still resulting from the government shutdown, an unprecedented expansion of the M2 money supply, and higher energy prices. While supply chain problems will likely resolve over the next year, the other two issues may be with us awhile. The money supply has grown by 33% in one year versus a normal 6% annual increase. Energy prices have increased substantially, which translates into cost push inflation, and any significant capacity expansion in US energy seems unlikely in the next few years.

We have never been convinced that this particular period of higher inflation is as temporary or “transitory” as the Federal Reserve initially implied. It is beginning to seem that they are finally arriving at that conclusion as well. Or, they always believed this to be the case and did not wish to make it a public statement.

We would contend that each individual should essentially have their own personal inflation model based on their own behaviors. However, that is not terribly practical for the Bureau of Labor and Statistics. As a result, we believe this places a greater importance on financial planning, particularly for those closing in on retirement who will not have increasing wages to go along with increasing prices. Having a greater understanding of where your spending is headed based on your lifestyle goals is a key part of a well-designed financial plan. As inflation continues to climb, this is something at Landmark we try to address for all clients with a look towards their longer-term plans.

Filed under: Articles

Comments: Comments Off on Inflation Today: What is it Really?

Opportunity cost is defined as the potential benefit an investor misses out on when choosing one alternative over another. Every investor can likely think of an example of something that they once owned and sold at the wrong time or planned to buy and chose not to do so. Some of those examples can be quite frustrating in hindsight. However, in some cases, even what seems like the wrong decision may have still been the correct decision.

It’s never a good idea to make investment decisions based on where you were, rather than making decisions based on where you are. In financial planning investors are routinely faced with these decisions, even if you are not an active trader. Such examples can be something as simple as choosing to buy a car in cash versus financing a car purchase. Or, possibly whether or not you should pay off your mortgage or not.

Imagine a situation in which you had an investment portfolio of $200k that was averaging 7% annually. Simultaneously, you have a large cash position in the bank of $100k earning just 0.50%, with a mortgage balance on your home of $100k in which you are paying 3.5% interest. Simple math would tell us that you are better off investing that money at a 7% average return than keeping it in the bank or paying off the loan. However, depending on your personal situation, there may be more than one correct answer.

As an example, imagine you are closing in on retirement or already retired and by nature are very conservative. A portfolio that is averaging 7% annually is not necessarily going to guarantee such a return every year. It is a reasonable long-term assumption, but in the short term can be negative for several years. Committing capital to a portfolio may not be worth the volatility to you, particularly if the lack of a cash position will drive you to panic in the face of market volatility and sell your investments at an inopportune time.

So perhaps you should pay off the mortgage and save the extra 3%, which is the difference between the interest rate on the loan and the savings account rate. Well, this doesn’t always make sense either. Every investor should have an emergency fund of 6 months to 1 year of cash to fund their lifestyle. Without such liquidity, if you pay off your loan you won’t have the liquidity to address an emergency, and you may have to resort to selling assets such as your brokerage account that was averaging 7%. The unwritten rule of “Murphy’s Law” tells us that emergencies tend to come at inopportune times, and you may be selling investments at a low point in financial markets. Another possible issue is you may be forced to pay capital gains tax at an inopportune time.

Additionally, depending on how far into the mortgage you are, it may not make sense to pay it off. If you are 25 years into a 30-year loan, even though your interest rate is 3.5%, most of that interest was paid in the beginning, and you are now paying primarily principal. Paying off the loan at that point may not amount to much of a savings at all. Sometimes keeping cash on hand is the correct decision.

Even if your portfolio continues to earn very good returns, it doesn’t mean the correct decision is to commit all of your capital there. Investors have no control over, nor can they accurately predict short-term volatility with any degree of certainty on a consistent basis. Neither can the best of investment professionals. While the “would have, could have, should have” feeling may rest in the pit of your stomach, you may still have made the correct prudent decision.

Similar examples can made in terms of portfolio allocation. While a well-diversified portfolio is the prudent decision to fund your future as well as current retirement goals, we can all think of that example of a stock that you believed in, or just had a feeling about that could have made you an extraordinary amount of money. However, investors tend to remember the opportunity cost they missed that would have worked out well. That is where your regret comes from. We tend to forget the ideas we had and didn’t act on that would have ended catastrophically. Sometimes it’s the moves you didn’t make that are the best decisions you’ve made.

Financial planning is about having a strategic approach to achieving a set of goals that will take you from point A to point B with the least amount of risk that is necessary. This means that in the end, the correct decision isn’t always the one that yields the best outcome. The correct decision is the one with the most likely outcome of accomplishing your goals.

Filed under: Articles

Comments: Comments Off on Opportunity Cost: What it Means to You