In the world of investing, particularly for those holding large positions in a single stock, often acquired through employee compensation, inheritances, or successful investments, managing risk is crucial. A concentrated stock position can expose an investor to significant volatility tied to one company’s performance. One effective hedging strategy to mitigate this risk without immediately selling the shares (and potentially triggering substantial capital gains taxes) is the options collar strategy. Let’s examine the basics of how an options collar works and its key benefits for investors with concentrated holdings.

What Is an Options Collar Strategy?

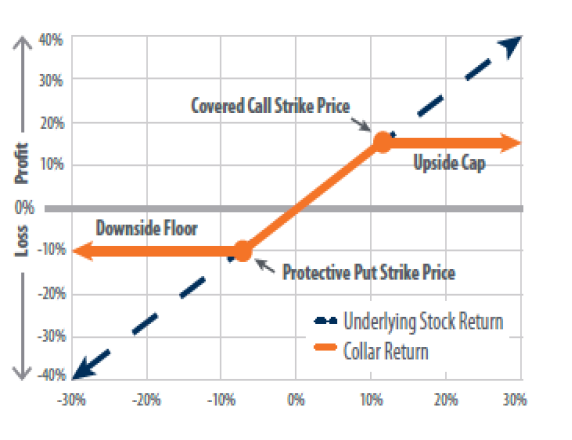

An options collar, sometimes called a “protective collar,” is a risk-management technique that combines owning the underlying stock with two options positions: buying a put option and selling a call option. It essentially creates a “collar” around the stock’s price, setting both a floor (minimum value) and a ceiling (maximum value) for potential gains and losses over a specific period.

- Long Stock Position: You already own shares of the stock.

- Protective Put: You purchase an out-of-the-money put option, which gives you the right to sell the stock at a predetermined strike price if the stock price falls. This acts as insurance against downside risk.

- Covered Call: You sell an out-of-the-money call option, giving the buyer the right to purchase your stock at a higher strike price if the stock rises. The premium received from selling the call helps offset the cost of buying the put.

The put and call options typically have the same expiration date and are structured on a share-for-share basis (e.g., one put and one call per 100 shares of stock). The goal is to limit exposure to large price swings while retaining ownership of the stock. This strategy is particularly appealing to long-term holders who are bullish on the stock but want protection from short-term declines.

How Does an Options Collar Work?

To implement a collar, the following steps take place:

- Assess Your Position: Start with your existing stock holdings. For simplicity, assume you own 100 shares of XYZ stock trading at $100 per share.

- Buy a Protective Put: Select an out-of-the-money put with a strike price below the current stock price, say $90. If XYZ drops below $90 by expiration, you can exercise the put to sell at $90, limiting your loss. The cost might be $2 per share (or $200 for 100 shares).

- Sell a Covered Call: Choose an out-of-the-money call with a strike price above the current price, say $110. You receive a premium, perhaps $2 per share ($200 for 100 shares), which covers the put’s cost, making it a “zero-cost” or a “cashless” collar.

- Monitor and Expire: At expiration:

- If XYZ stays between $90 and $110, both options expire worthless. You keep the stock and any net premium.

- If XYZ falls below $90, the put protects you by allowing a sale at $90.

- If XYZ rises above $110, the call is exercised, and you sell at $110, capping your upside.

The net effect is that your potential loss is capped at the put strike minus any net cost, while gains are limited to the call strike plus any net premium received. This creates a defined risk-reward profile, often at little to no upfront cost if the premiums balance out. The illustration above courtesy of First Trust demonstrates how this protection can work.

Example of an Options Collar

Suppose you hold 1,000 shares of ABC Corp (ABC) at $150 per share, a concentrated position from stock options vested during your employment. You’re concerned about a market downturn but don’t want to sell and pay taxes on gains.

- Buy 10 put contracts (1,000 shares) with a $140 strike (out-of-the-money), costing $5 each ($5,000 total).

- Sell 10 call contracts with a $160 strike (out-of-the-money), receiving $5 each ($5,000 total).

This is a zero-cost collar. Outcomes at expiration:

- If ABC drops to $130: Exercise puts to sell at $140, limiting loss to $10 per share (from $150 to $140).

- If ABC rises to $170: Calls are exercised; you sell at $160, gaining $10 per share (plus any dividends).

- If ABC stays at $150: Both options expire; you retain the stock unchanged.

This setup hedges against a 6.7% drop while capping upside at about 6.7%, providing stability.

It’s also important to note that if you are not required to exercise the options contracts. Instead, you may simply close them out. This means if you bought a put for downside protection, rather than exercise the put, you could simply sell the contract for the profit. The same is true with the call option. If you see the stock appreciate above the price of the call you wrote and you don’t want to sell the stock and realize the capital gain, you can simply buy back the calls, realize the tax loss, and then sell another call at a higher strike price to generate additional income.

A potential risk is that an option contract could get exercised before maturity and force a taxable transaction on you that you had not intended to realize before you had the opportunity to close out your position. To mitigate this risk, some firms that specialize in these strategies will utilize European style options which cannot be exercised before their expiration date. This allows flexibility to close out positions and reestablish new positions before the contracts are exercised.

Benefits of Using an Options Collar for Concentrated Stock Positions

Concentrated positions carry “single-stock risk,” where company-specific events can erode wealth rapidly. An options collar addresses this without full liquidation, offering several advantages:

| Benefit | Description |

| Downside Protection | The protective put acts as insurance, capping losses if the stock plummets. This is vital for concentrated holdings, reducing exposure to volatility without selling shares. |

| Tax Efficiency | By hedging instead of selling, you defer capital gains taxes. This is especially beneficial for low-basis stock (e.g., from RSUs or inheritances), allowing you to maintain ownership while managing risk. |

| Income Generation | Selling the call provides premium income, which can offset the put’s cost or even result in a net credit. This enhances returns on idle stock positions. |

| Low or No Cost Implementation | A “cashless collar” balances premiums, making it accessible without tying up additional capital. This is ideal for investors who want protection but have limited liquidity. |

| Flexibility and Customization | Adjust strike prices and expirations to match your risk tolerance—wider collars allow more upside but less protection, and vice versa. It also enables strategic borrowing against the collared position for liquidity needs. |

| Gradual Diversification | Over time, collars can facilitate selling portions of the position or rolling strategies to diversify without a massive tax hit. |

These benefits make collars popular among executives, founders, and high-net-worth individuals with oversized positions in employer stock. However, it’s not without drawbacks: upside is limited, opportunity costs exist if the stock surges, and transaction costs can affect outcomes.

The options collar strategy offers a balanced approach to hedging concentrated stock positions, providing downside protection at the expense of capped gains. By understanding its mechanics and leveraging it judiciously, investors can sleep better knowing their wealth isn’t entirely at the mercy of one stock’s performance. As markets evolve, tools like collars can be essential for sophisticated risk management.

Implementation of this strategy requires a great deal of knowledge and expertise about the options markets and is probably best delegated to professionals that specialize in creating these structured product strategies. Fortunately, there are a number of companies with the level of expertise. Consulting with your financial advisor on such a strategy is worth the conversation if you are someone with a significant concentrated position that can substantially impact your net worth.

About the Author

Joseph M. Favorito, CFP® is a Certified Financial Planner® as well as the founder and managing partner at Landmark Wealth Management, LLC, a fee-only SEC registered investment advisory firm. He specializes in helping individuals and families develop comprehensive financial strategies to achieve their long-term goals.