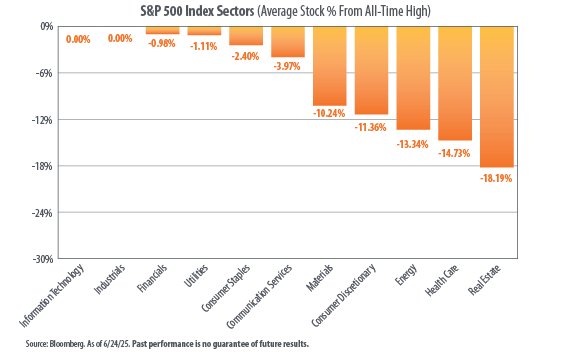

Through the second quarter of 2025, the U.S. stock market continues to show an uneven recovery beneath the surface, with wide disparities in how close individual sectors are to their previous all-time highs. According to data compiled by Bloomberg, while some sectors have managed to re-claim and even surpass their record levels in early July, others remain meaningfully off of their all-time highs.

The chart above tracks the average percentage each sector is trading below its all-time high as of June 24th, offering a helpful lens into market breadth and sector leadership.

Key Takeaways:

- Information Technology lead the market, with no average decline from the all-time highs and is now setting new highs in early July. This highlights how Big Tech, and associated companies have been the primary engine driving market gains in 2025, continuing a trend that has largely dominated the post-pandemic period.

- Industrials, Financials, and Utilities are also holding up relatively well, with average stock declines of less than 2.5% from their highs. This resilience may reflect expectations for ongoing infrastructure spending, solid economic growth, and expected financial sector profitability amid a stabilizing interest rate environment.

- Consumer Staples and Communication Service stocks show modest pullbacks, down 3.97% and 10.24% respectively from their highs. Consumer Staples tend to perform defensively in uncertain environments, while Communication Services, a category that includes media, entertainment, and internet platforms, has been more mixed, with some large-cap names outperforming while smaller player’s lag.

- Sectors tied to economic cycles and interest rates remain notably weaker.

- Materials (-11.36%) and Consumer Discretionary (-13.34%) stocks have struggled amid uneven global demand and cautious consumer spending.

- Energy (-14.73%) and Health Care (-14.73%) are under pressure, with Energy facing volatility from commodity markets and Health Care contending with regulatory and reimbursement uncertainty.

- Real Estate is the clear laggard, down an average of 18.19% from all-time highs. Persistent headwinds from elevated interest rates and softening commercial property valuations continue to weigh heavily on this sector.

What This Tells Investors

The data paints a picture of a market where leadership is increasingly concentrated. While headline indices like the S&P 500 have posted strong returns in 2025, much of those gains are driven by a handful of sectors, particularly Information Technology. Beneath the surface, many sectors and individual stocks have yet to recover to their prior peaks.

This kind of divergent performance underscores the importance of sector diversification within your asset allocation. It also hints at potential future opportunities, as historically, wide sector dispersions eventually experience a reversion to the mean.

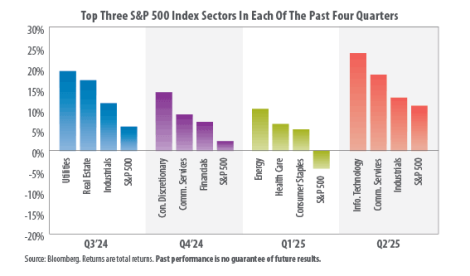

However, when we look back at the last four full quarters as the chart below demonstrates, we can see that there has been a significant rotation among these sectors from quarter to quarter.

This data further reinforces that there is no reliable way to time markets or sectors within the market, and why having exposure to all assets and sectors still makes the most sense.

About the Author

Joseph M. Favorito, CFP® is a Certified Financial Planner® as well as the founder and managing partner at Landmark Wealth Management, LLC, a fee-only SEC registered investment advisory firm. He specializes in helping individuals and families develop comprehensive financial strategies to achieve their long-term goals.