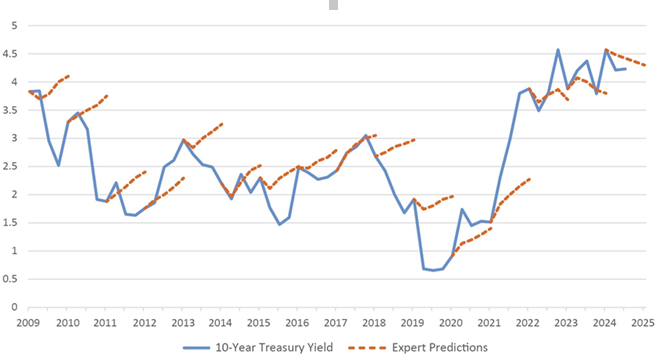

From the aftermath of the 2008 global financial crisis through the low-rate era of the 2010s and into the early 2020s, economists, strategists, and professional forecasters repeatedly anticipated higher long-term yields than what materialized. The chart above provided courtesey of Hartford Funds using data from the Philadelphia Federal Reserve and FactSet demonstrate the following:

- 2009–2015: Actual yields plunged from around 3.8% to lows near 1.5–2%, while predictions hovered higher (often 2.5–3.5% or more), expecting a quicker normalization after the crisis.

- 2016–2020: Yields stayed suppressed (frequently below 2.5%, dipping under 1% in 2020 amid pandemic stimulus), yet forecasts continued pointing upward, reflecting expectations of stronger growth, inflation rebound, and Fed tapering.

- 2021–2022: Rates bottomed near 0.5–1% before surging sharply to over 4%, finally catching up to (and sometimes exceeding) predictions.

This over-optimism on yields translates to underestimating how long the era of ultra-low interest rates would last.

Why Did Experts Get It Wrong for So Long?

Several structural and unexpected factors explain the systematic overestimation:

- Repeatedly delayed inflation and growth rebound — post-2008, many expected a return to pre-crisis norms (inflation near 2–3%, robust growth). Instead, slower productivity growth, globalization, and high savings rates kept inflation and yields subdued for over a decade.

- Extraordinary monetary policy — The Federal Reserve’s prolonged quantitative easing (QE), forward guidance, and zero interest rate policy anchored long-term yields lower than models predicted. Forecasters often underestimated how aggressively, and persistently central banks would intervene.

- Strong demand for safe assets — Global investors (foreign central banks, pension funds, insurers) piled into U.S. Treasuries as the world’s premier safe-haven asset, pushing prices up and yields down beyond what domestic economic models anticipated.

- The “lower for longer” reality — What began as a crisis response morphed into a multi-decade regime of depressed real rates and term premiums. Economists adjusted forecasts gradually, but rarely enough to match the persistence of low yields.

The Dramatic Reversal (2022–2025)

Everything changed starting in 2022. Aggressive Fed rate hikes to combat inflation finally drove the 10-year yield sharply higher, from under 1.5% in early 2021 to peaks above 4.5% in 2023–2024 and hovering around 4.2–4.3% as of early 2026.

Rates surged above the predictions, especially during 2022–2023, as inflation proved stickier and growth more resilient than most expected. By 2024–2025, rates and predictions converged more closely, with actual yields settling in the mid-4% range aligning better with updated expert views (current consensus forecasts for 2026 often cluster around 4.0–4.3%).

What This Chart Tells Us Today

The graph serves as a powerful reminder of forecasting humility in economics:

- Interest rate predictions are notoriously difficult, especially over multi-year horizons, because they depend on unpredictable policy responses, geopolitical events, and shifts in investor behavior.

- Consensus can be dangerously wrong when structural changes persist for longer than anticipated.

- Recent alignment suggests forecasters may now be better calibrated to a “higher for longer” regime influenced by larger deficits, sustained investment demand, and normalized inflation targets.

For investors, borrowers, and policymakers, the chart underscores why the 10-year Treasury yield remains a critical benchmark, guiding mortgage rates, corporate borrowing costs, stock valuations, and even federal debt servicing expenses. As of February 2026, with yields near 4.2%, we’re in a very different world from the sub-2% regime that dominated headlines for much of the 2010s.

This visual history of optimism meeting reality is a classic case study in why markets often humble even the sharpest minds. And it serves as yet another reminder as to why investing via the timing of any aspect of financial markets in the short term is often an unreliable exercise in futility.

About the Author

Joseph M. Favorito, CFP® is a Certified Financial Planner® as well as the founder and managing partner at Landmark Wealth Management, LLC, a fee-only SEC registered investment advisory firm. He specializes in helping individuals and families develop comprehensive financial strategies to achieve their long-term goals.