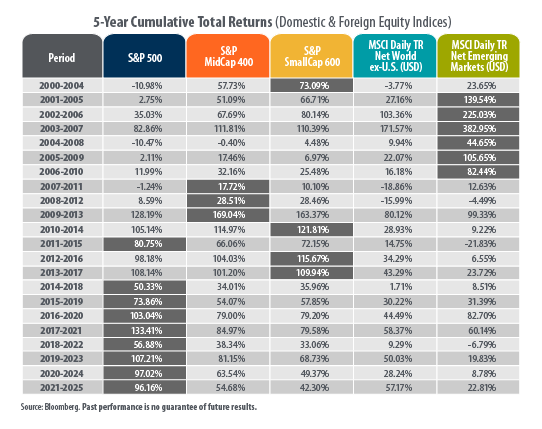

From the early 2000s through roughly 2010, the story was one of U.S. underperformance. The dot-com bust, the 2008 global financial crisis, and a sluggish recovery left the S&P 500 battered. Cumulative 5-year returns during windows like 2000–2004 (−10.98%) and 2004–2008 (−10.87%) were poor. Meanwhile, international developed markets (MSCI World ex USA) and especially emerging markets (MSCI Emerging Markets) delivered strong gains, often in the 20–80%+ range over similar periods. Emerging markets, fueled by rapid growth in China, India, Brazil, and others, were the clear outperformers in the mid-2000s.

This pattern flipped decisively around 2009–2012. The U.S. stock market recovery accelerated, powered by technological innovation and accommodative monetary policy led to corporate earnings strength, and later the explosive growth of mega-cap tech leaders. From 2010–2015 onward, the S&P 500, along with mid-cap (S&P Mid-Cap 400) and small-cap (S&P Small-Cap 600) indices, posted towering cumulative returns, frequently 80–120%+ over rolling 5-year windows. Meanwhile, developed international markets lagged significantly, and emerging markets turned volatile or flat-to-negative in many recent periods.

The most recent windows highlight the extent of U.S. outperformance:

- 2020–2024: S&P 500 +97%, S&P Mid-Cap +63%, S&P Small-Cap +49%, while international stocks posted +28% and emerging Markets were +8%.

- Earlier stretches like 2018–2022 showed U.S. large-caps at +56%, while internation stocks were +9% and emerging markets were negative.

U.S. small and mid-caps historically edged out or matched large-caps in these strong periods. However, during this stretch, we have seen more outperformance from the large-cap space due to the performance of the “magnificent seven” stocks.

Why the Shift Lasted So Long

Several structural factors explain the prolonged U.S. leadership since around 2010–2012 (now stretching well over 15 years in many rolling measures):

- Superior earnings growth, especially in technology and innovation-driven sectors.

- A stronger U.S. dollar for much of the period (a headwind for foreign returns when converted back to USD).

- More favorable corporate tax environments and capital market depth in the U.S.

- Global investors’ preference for perceived safety and liquidity in U.S. assets during uncertain times.

International and emerging markets faced headwinds like slower growth in Europe/Japan, geopolitical risks, commodity cycles, and China’s structural slowdown.

The Diversification Debate in 2026

This table fuels one of the most heated ongoing discussions in portfolio construction: Should investors stick with the proven U.S. winner or diversify into cheaper international/ex-U.S. markets?

The pro-U.S. argument is straightforward. “Don’t fight the tape.” The data shows U.S. equities (especially large caps) have delivered superior risk-adjusted returns for well over a decade. Recent rolling periods reinforce this momentum.

The diversification case points to history’s cycles. No market regime lasts forever. The early 2000s showed international/emerging leadership after U.S. weakness.

Valuations matter: By late 2024/early 2025, U.S. stocks (particularly growth/tech) traded at stretched multiples relative to international developed and emerging markets, which were at historically cheap levels compared to the U.S. stocks. Mean reversion, where cheaper assets eventually catch up, has precedent. A weaker dollar, rebounding global growth, fiscal stimulus in Europe can be the catalyst for change.

Recent developments in 2025 saw international stocks outperform U.S. equities significantly, driven by dollar weakness, valuation catching up, and rotation toward value-oriented international names. Yet opinions remain split, with some analysts expecting U.S. earnings strength to resume leadership in 2026, viewing international rallies as potential “value traps” unless fundamentals improve markedly.

Bottom Line

This table above is a powerful visual reminder that equity leadership rotates over long horizons. The U.S. has enjoyed an extraordinary run, turning what was once painful underperformance in the early 2000s into overwhelming dominance over the last decade plus. International and emerging markets have spent years in the wilderness but carry the seeds of potential reversal through lower valuations and cyclical tailwinds.

For long-term investors, the data supports thoughtful global diversification, not as a bet against America, but as recognition that no single market owns the future indefinitely. Past performance is never a guarantee, but patterns like these help frame the timeless question of, are we nearing the end of one era…or just the middle of it?

About the Author

Joseph M. Favorito, CFP® is a Certified Financial Planner® as well as the founder and managing partner at Landmark Wealth Management, LLC, a fee-only SEC registered investment advisory firm. He specializes in helping individuals and families develop comprehensive financial strategies to achieve their long-term goals.