How Long Does it Take the Market to Recover?

A common theme of concern among investors that most financial planners will hear just before a client is about to retire, or possibly already retired is that “I don’t have time to recover from a big market downturn”. The assumption is that you’re too far along in your life to be able to hold your investments long enough to see them rebound. While nothing is guaranteed, if history is any kind of indicator, that seems unlikely for most people.

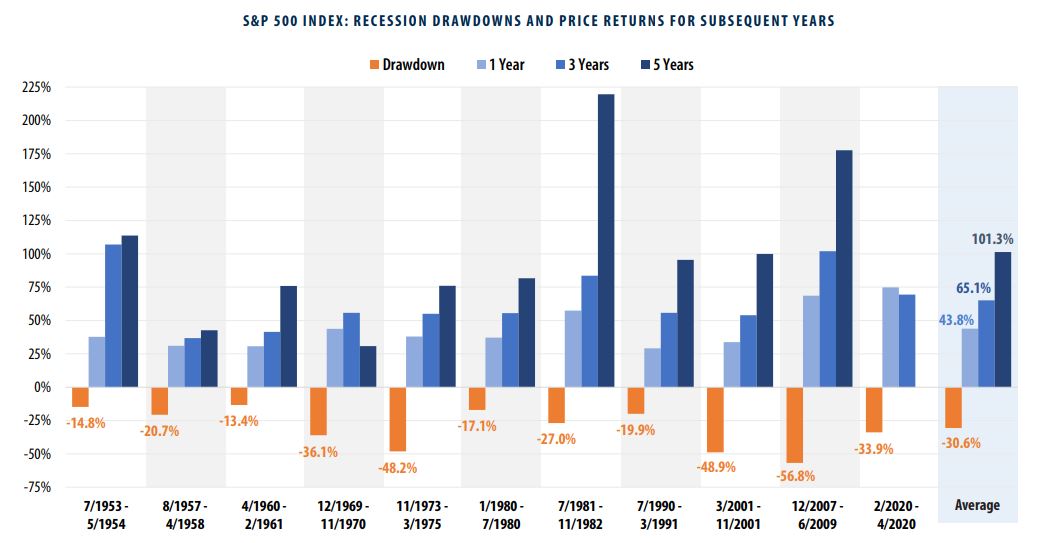

What we can see from the chart above provided by First Trust is that on average, a market downturn during a recession is approximately -33%, and the average bear market lasts approximately 11 months. However, just 12 months following that market downturn, the average subsequent return for the S&P 500 since 1953 is about 44%. It just happens to be that a 44% return is roughly what you need to achieve to nearly a full recover from a -33% decline.

When we look a bit further into the future, the 3-year return on the S&P 500 is 65%, and 5-years out it’s a little better than 101%.

Let’s put this into perspective. If your timing was terrible, and you invested $100,000 the day before the market selloff began, and assumed the average downturn lasted 11-12 months, this is what your portfolio would look like:

12-months later – $67,000

24-months later – $96,346

48-months later – $110,558

72-months later – $134,871

It’s also important to point out that these averages assume that you would have 100% of your investment portfolio in stocks, which is rarely appropriate. Most investors are more suited to have a well-diversified asset allocation of many different asset classes to mitigate risk. As a result, the decline should not be as substantial, and the time to recovery is even shorter. A comparative look at the impact of market downturns on a well-diversified asset allocation, versus a portfolio fully invested in stocks can be seen in the prior article from 2020:

https://landmarkwealthmgmt.com/market-corrections-how-much-impact-do-they-have/

This is not to suggest that market downturns would not have a significant impact on a retiree’s portfolio. In fact, it can be significant if it happens early in retirement when an income is needed from an investment portfolio. Selling into losses can accelerate asset depletion much faster. This is due to what is often referred to as the Sequence of Returns Risk.

This risk can be explained in more detail in this prior article:

https://landmarkwealthmgmt.com/sequence-of-returns-a-substantial-risk-to-retirees/

However, it is more impactful when an investor sells out of fear and panic, which typically happens at the worst possible time, as opposed to maintaining a sound investment strategy. It is extremely important that an appropriate risk level is identified and implemented based on the cash flow needs of a particular investor. If this is done correctly, panic should never be the response. A good financial planner will help evaluate your budget and how it progresses over the years to adapt the risk level accordingly and maintain a reasonable cash flow from the portfolio.

It’s important to understand that while history doesn’t always repeat itself precisely, it tends to rhyme. Markets have had an extraordinary ability to revert back to their statistical mean over the long run. And as the evidence demonstrates, historically that isn’t a very long wait most of the time.