What Role Should Commodities Play In A Portfolio?

In the course of building a long term investment portfolio, the focus should be based on not just returns…but risk-adjusted returns. The premise behind a multi-asset portfolio is combining multiple asset classes in which each produces a positive long-term return, without being highly correlated. This can produce more consistent longer-term returns…while offering a lower overall degree of portfolio volatility. One of these asset classes is the commodities market.

Commodities independently have historically been more volatile than stocks with a higher standard deviation of returns over the last 40 plus years. Since 1970, US large cap equities have posted a standard deviation of 17.63 versus 24.29 in the GSCI commodity index. However, when combined as a component in an overall asset allocation…they can serve an important role. All too often investors chase after the most recent top performing assets. Using commodities as an example, the last five years have been less favorable as the US and most of the developed world has seen a somewhat anemic economic recovery from the 2008 recession. Yet, if we were to examine average returns of the broad based commodities market in comparison to the US large cap stock market, we find that the average returns are not much different. During the period of 1970 thru 2013…US large cap equities posted average annual returns of 10.41%, while commodities posted average annual returns of 9.21%.

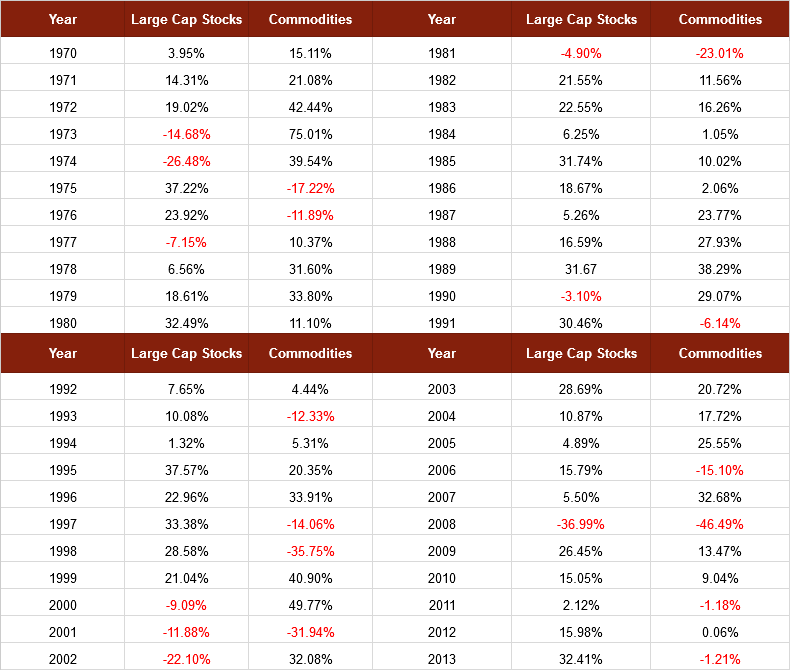

What is important to note by looking at the following chart is the individual year-over-year returns. What we find is that in many years in which stocks suffered…commodities offered a cushion to portfolio returns. In many years the inverse was also true. During periods of extraordinary deflationary panics such as 1929 or 2008, asset classes often become highly correlated. However, we also find that in years like 2002 as the tech bubble had imploded and the US was recovering from the events of Sept 11th…commodities offered a substantial reduction in overall portfolio volatility.

It is also important to recognize that a proper investment asset allocation is defined by multiple asset classes and sub-asset classes of satellite investments to compliment core holdings like US large cap stocks. Commodity holdings are just one part of such a strategy. As a result of the high volatility that accompanies a broad basket of commodity holdings, investors should likely limit exposure in the commodities markets to a reasonable percentage of their portfolio. Investors who use the aid of a financial advisor should consult with them before incorporating new holdings into their longer term investment strategy.

Commodities as an asset class can be a bit more difficult to own outright. It is unadvisable for investors to trade in futures contracts around the commodity complex, unless this is something with which they have had significant experience. In most cases it is much more suitable to use a mutual fund or an ETF which diversifies across a broad range of futures contracts. Unfortunately, due to the structure of many commodity products in the ETF product space, they often report tax liabilities on a K-1 rather than a 1099. This is irrelevant for retirement accounts, and does not increase liability…but may delay income tax returns for non-retirement accounts, as K1’s tend to be issued later and often close to the tax deadline. In the event that an investor wishes to avoid the K1 filings, there are a number of open-ended traditional mutual funds that have broadly diversified commodity holdings. As in any mutual fund, expenses should be monitored in addition to portfolio holdings to ensure the fund achieves a truly diversified set of commodity holdings consistent with the benchmark.