The Value vs Growth Rotation: When Will it Happen?

In the decade ending in 2021, the Russell Growth 1000 Index doubled the performance of the Russell 1000 Value Index. That partially reversed in 2022 when the Russell Value outperformed the Russell Growth by 22%. Then in 2023, the Russell Growth index once again outperformed the Russell Value Index by 23%, negating the outperformance of the value index in 2022. This unusually large divergence has made growth versus value a popular discussion topic.

In 1934 Benjamin Graham, a British born financial analyst wrote “Security Analysis”. Graham is often thought of as the founder of value investing, as well as laying the groundwork for index funds. Graham suggested paying such a low price for a stock that if you were only partially correct you weren’t likely to lose much money. He believed a business value was closely tied to book value, which was a relatively stable number. However, stocks generally correlate more to earnings than book value, making them more volatile. Graham believed that investors could purchase depressed shares when earnings were low and then wait for better times when the price would climb back to book value. Essentially, value investing is simply buying at a discount.

Graham once said, “The intelligent investor is a realist who sells to optimists and buys from pessimists.”

Growth investors often pay little attention to book value, instead looking for growing earnings. Companies with above-average earnings growth tend to sell at high price-to-book ratios. Investors often think of value investing as cheap stocks that didn’t grow very much, and growth stocks as high-growth businesses that were very expensive. Growth investors believe they owned “exciting” businesses poised to outperform the market, while value investors expect to outperform because their “boring” stocks usually made more money.

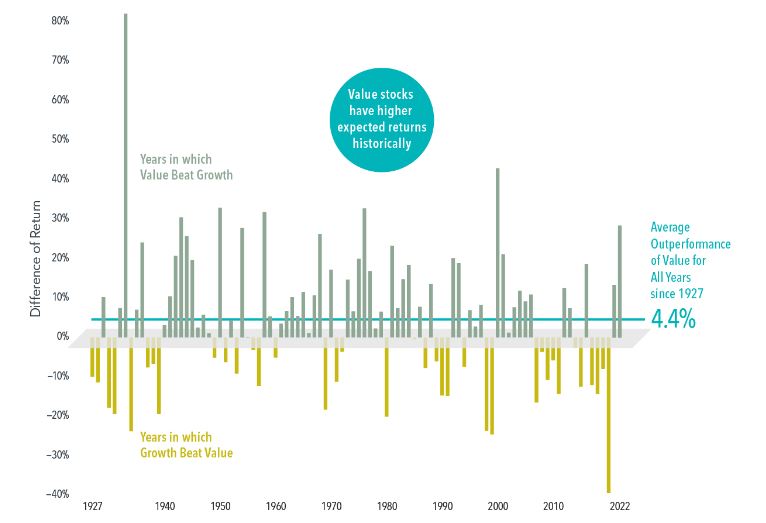

The chart above provided by Dimensional Fund Advisors demonstrates that since 1927 value investing has outperformed growth by about 4.4% annually. However, this isn’t true in recent history.

What we can see from this chart is that since 2014, growth investing has dominated value investing as we referenced earlier. However, investing is typically counterintuitive to the instincts of the average investor. The greatest opportunity is usually found in that which has been out of favor. We are very much of the belief that there is always a reversion to the statistical mean. Whether or not we are about to see that reversion now is unknown. If there is a reversion, and value investing once again is the more favorable place to be, how long will it last? The reality is that nobody can time this with any degree of precision anymore than we can time markets in general. What we do believe is that rather than trying to pick the precise time to change a portfolio, an equal degree of exposure to both value and growth is the more ideal approach.