Investing: Is it Gambling?

Investors often refer to the stock market as gambling, no different than that of a casino. Well, we would agree with that sentiment. But not in the way most investors think. As most people are aware, when you enter a casino the odds of every game favor the casino, some by a wider margin than others. Simply put, while you may win sometimes, if you stay at the roulette wheel long enough, eventually you will lose. As they say, the house never loses, because it’s simply about statistical probability over time.

However, what if you can be the house instead of the player at the roulette table. While it may not be as exciting, it is certainly better financially. Well, when you invest in the stock market in a diversified way, you essentially become the house. You own the underlying businesses inside the fund that you bought.

As an investor any company can go out of business. However, presuming that you’re not buying a single company, or a very small number of companies, but instead have broad market diversification, the odds are dramatically in your favor. If you invest in the markets, you may lose in the short-term but if you stay invested long enough, the odds are dramatically in your favor. It is essentially the exact opposite of casino gambling from the perspective of the casino customer.

Well, how good are your odds?

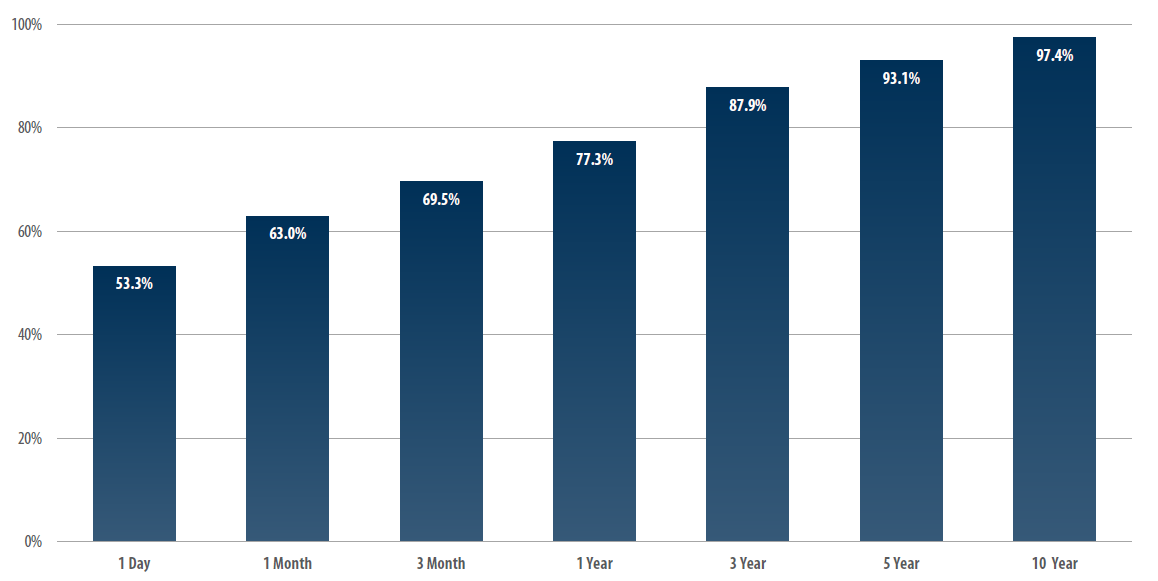

Looking at the data above, courtesy of First Trust, we can see that on any given day your odds of an investment in the S&P 500 index yielding a positive result is a little better than a 50% chance. If you hold that same position for a month, the odds increase to better than 60%. After a year, it’s better than 75% of the time. If we look at a 10-year time frame, the probability jumps to better than 97%.

As we can see, the odds of making money in the longer term are excellent. This data is also based on a portfolio that is 100% in US Stocks. When other assets are introduced into an investment strategy, such as more conservative fixed income investments, the odds only get better. This is typically the case for most investors, especially those closer to retirement. In fact, there has never been a 10-year period in which a portfolio that is evenly balanced between stocks and bonds has posted a negative period.

As we suggested earlier, investing is like gambling in a casino, and you get to own the casino.