Inherited IRA Beneficiary Rules Clarified

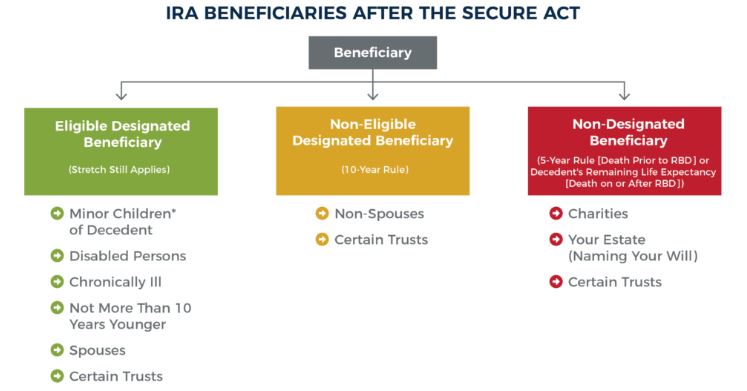

After many years of confusion, the IRS has finally clarified the rules around Inherited IRA’s. Under the old rules when a non-spouse inherited an IRA, the beneficiary was required to take a distribution every year based upon their life expectancy. As a result of the SECURE ACT 1.0, which took effect in 2020, several rules for retirement accounts changed. Among these were changing the required distribution age, establishing categories of beneficiaries such as an eligible designated beneficiary and non-eligible beneficiary, and changing the length of time required to deplete an account via required distributions.

Originally, Inherited IRAs were subject to a mandatory distribution based upon the life expectancy of the Inheritor. Secure Act 1.0 changed the distribution rules for non-eligible designated beneficiaries from a life expectancy withdrawal to having to withdraw the entire IRA balance by the 10th year after the passing of the original account holder. Non-eligible designated beneficiaries are most non-spouse beneficiaries, and some see through trusts.

An eligible designated beneficiary is a surviving spouse, a disabled or chronically ill person, person’s less than 10 years younger than the decedent, minor children and some see through trusts. Eligible designated beneficiaries have the option to stretch the IRA distribution over their lifetimes. The exception is when a minor child attains the age of majority, at which time the distribution schedule switches to the same 10-year rule.

The area under the new rules that left some ambiguity was whether a non-eligible designated beneficiary had to take at least some portion of the distribution annually. Over the last few years, the IRS waived the required distribution for non-eligible designated beneficiaries even when the decedent had already reached their required minimum distribution age prior to passing away. Whether the decedent had already begun taking their required distribution or not, the IRA account still needed to be withdrawn by the tenth year after the passing of the decedent.

The IRS finally clarified the rule, whereby a non-eligible designated beneficiary subject to the ten-year rule must take a required distribution each year. The account must be fully withdrawn by the end of the tenth year. This is true regardless of whether or not the decedent had reached the age of required distributions prior to passing away. What still has not been clarified is the amount of the annual distribution each year. While you must take withdrawals in each of the 10-years following the passing of the decedent, is there a minimum annual amount? At this point, that remains somewhat a question. It seems that they are implying that a minimum distribution each year must be taken equal to the life expectancy tables of the beneficiary. However, if only the minimum life expectancy withdrawal is met in the first 9 years, that would leave a sizeable lump sum in the 10th year.

As a result, some financial planning is still required, as you might have to take a rather large distribution in the 10th year if you haven’t taken relatively equitable withdrawals in the first 9 years. In many cases it may be wise to take distributions equally that are close to 1/10th of the account balance per year in order to spread out the tax liability until further clarity on the rules exists. To avoid an adverse taxable event, it would be prudent to plan so that you’re not surprised by a rather large tax bill in a single year. As always, talk with your tax advisor or financial professional to determine the best course of action.

It is also important to note, these rules do not take effect until January 1st of 2025.