Fixed Income Outlook: 2024 & Beyond

Fixed income as an asset class should always be a fixture to some extent in any well-constructed asset allocation strategy. However, investing in fixed income is not without its own risks. Bonds can pose various risks. Among them are:

- Credit Risk – The risk of the issuer defaulting.

- Interest Rate Risk – The risk of rates rising after you’ve purchased a bond.

- Inflation Risk – The loss of purchasing power more than the interest you are earning on a bond.

- Liquidity Risk – The devaluation of a bond due to the lack of demand from a shock to the financial system.

Investing in an individual bond as opposed to a diversified bond portfolio can substantively increase these risks. The bond market in most years has been a more stable asset class than the stock market, yet with lower historical returns. This is because as a bond owner you are a lender of cash to a corporation or government agency rather than a stockholder in a potentially growing business.

As a comparison, the S&P 500 Index has been positive approximately 75% of the time, whereas the Barclays Aggregate Bond Index has been positive 92% of the time. Historically speaking, a bad year for bonds was in the vicinity of a -2% decline. A very bad year would be a -5% decline. However, in 2022 the Barclays Aggregate Bond Index declined by -13%, which was the worst decline in more than 200 years.

This decline was due to the unprecedented speed at which the Federal Reserve increased the Fed Funds rate to combat inflation. Interest rates climbed from near zero, to what is now 5.50%. While a 5.50% Fed Funds rate is not unprecedented, such a fast increase was a shock to the financial system after nearly two decades of close to zero interest rates.

As with any significant decline, this can create opportunities. As a result, it appears that there are many areas of opportunity in the current bond market. Many areas in fixed income are still trading below their par value, which is the value at which a bond will mature at. This means you can buy many bonds at a discount to maturity, plus collect the cash flow of interest payments. Many fixed-income managers see this as a great opportunity.

Additionally, the opportunity may be due to the anticipated next move of the Federal Reserve. While we can never be certain of their next policy move, fixed income managers will tend to position themselves around such expectations. They examine the economic environment and anticipate what the Federal Reserve response is likely to be. Again, there is no guarantee they will be right. Let us remember that in 2021 the Federal Reserve was calling inflation “transitory” and saw no need for concern. Not long after they realized they were wrong and began an unprecedented policy shift.

In looking at the current economic landscape, it seems unlikely the Federal Reserve will be raising rates again any time soon. The probability of a rate cut is much higher in the short term. How much of a cut and precisely when is difficult to predict. This depends heavily on the degree of economic slowdown or recession that is approaching.

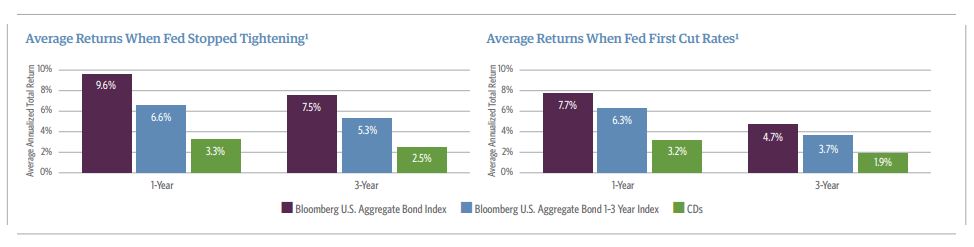

What we do have is some historical context around how bonds behave when the Federal Reserve stops increasing rates, as well as how bonds did when they first began to cut rates. What we can see from the above slide courtesy of Guggenheim Investments is the following:

In the 3-year period following the end of an increasing rate cycle, the average return of the Barclays Aggregate Bond Index is 7.5% per year.

In the 3-year period following the first rate cut, the average return of the Barclays Aggregate Bond Index is 4.7% per year.

What is interesting to note is that the 3-year returns are higher before the rate-cutting cycle begins. This may seem counterintuitive, as once the Fed actually cuts rates existing bonds should become more valuable. However, remember that financial markets are a discounting mechanism. What we are likely seeing in this data is that the marketplace had already begun to price in the decline in rates before they happened. This anticipation leads to bond buying, and increased prices.

This is another example of why market timing is so difficult, and why asset allocation and the exposure to all asset classes at all times is so important. However, this also tells us that at this moment in time, the bond market, which is coming off of an unusually bad period beginning in 2021 and culminated in 2022 is probably well positioned over the next few years. While we don’t encourage market timing, waiting to allocate the appropriate amount towards fixed income can be a costly mistake.