Elections: How Much Do They Matter?

The democratic process of electing our leaders is fundamental to our republic of representative government. But how much do elections matter? Well, that depends on what you are asking the question about. Elections certainly matter in terms of policy changes that can impact international relations, social policy, regulatory policy, as well as economic policy. However, it is important to understand that when evaluating financial markets, that is something entirely different then evaluating economics.

We have often said that the economy and the markets are more like cousins than siblings. What is meant by this is that there is a relationship between the two, but they are not necessarily going to move in tandem with each other.

Economic data, depending on what type of data you are examining, is often a broader look at the overall business conditions across the nation, or the world at a point in time. Analysis of the financial markets is more of a look at the valuation of assets at a point in time. Common sense would dictate that in an expanding economic environment in which we see stronger growth would eventually lead to higher asset prices. That is generally true, but that doesn’t mean that asset prices can’t or won’t increase during periods of anemic growth. During the post-2008 financial crisis period, we saw a very anemic growth rate in real GDP growth or nearly a decade. Yet, markets did very well during that period. There are various reasons that this can be true.

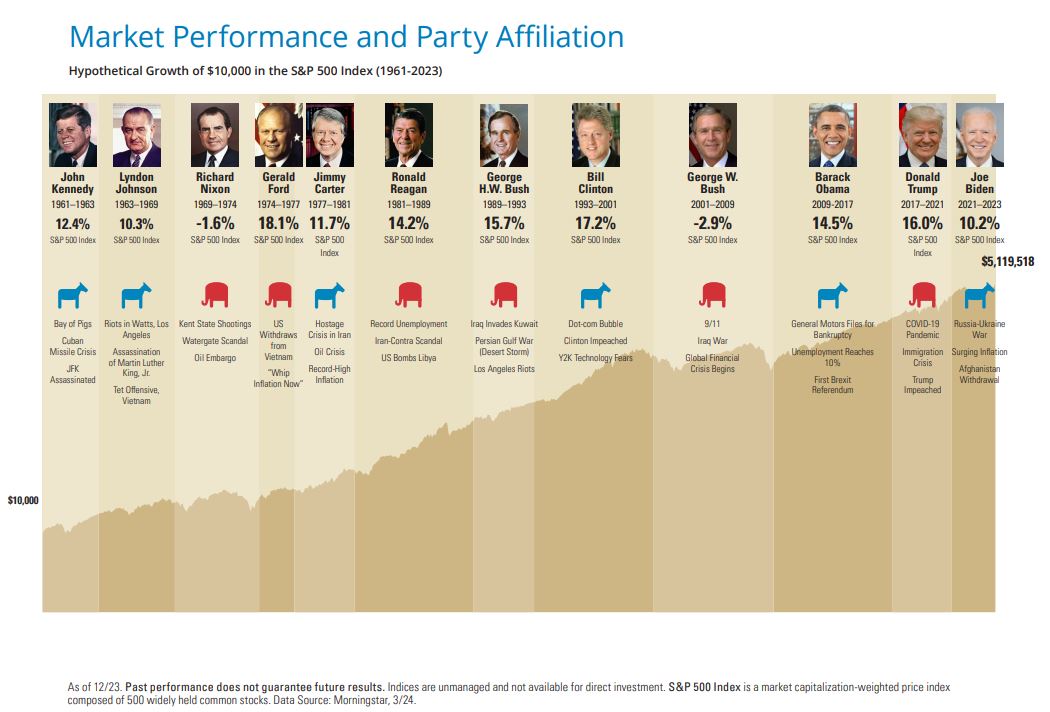

As an example, looking at the chart above provided by Hartford, we can see some data.

Since 1960, there have been only four Presidents that served a consecutive eight years in office. Looking at the last four such administrations we can see in the data the following:

During the Reagan Presidency, Real GDP grew at 3.5% annually, and the S&P 500 averaged a 14.20% annual return.

During the Clinton Presidency, Real GDP grew at about 3.9% annually, and the S&P 500 averaged a return of 17.2%

During the Bush (43) Presidency, Real GDP grew at 2.2%. and the S&P 500 averaged a -2.90% annual return.

During the Obama Presidency Real GDP averaged 1.70% annually, and the S&P 500 averaged a 14.5% annual return.

As we can see, there is a disconnect between economic growth and market growth, and no connection to any particular political party.

The lower rate of economic growth over the last two decades is concerning, and likely due to the massive rate of growth in entitlement spending. The lower growth rates are certainly not a positive for the economic conditions of the average citizen. However, although 3%-4% annualized average growth in GDP may no longer be achievable with the size of the current Federal spending levels, that does not mean that markets cannot continue to grow.

It’s important to point out that since 1960, the average rate of growth in the M2 money supply is about 4.50%-5.00% annually. As the money supply grows, those dollars must go somewhere, and many of them will chase after assets.

It’s also important to point out that we are not necessarily endorsing the Fed’s policies around money creation. However, printing money as a policy response to an economic crisis is the recent reality, and likely the future policy response the next time a crisis develops.

Remember that GDP is a measure of productivity, and the M2 money supply is a measure of new money in circulation amongst the population. If that latter grows faster than the former, the value of the dollar is declining, also known as inflation.

How do we best combat inflation?

The best answer to combating inflation is to own assets, as opposed to holding cash, which is declining in value. What this tells us is that even when the US economy is growing at a slower pace, the value of assets can still increase.

Not all of that increase will be due to inflation. There are also deflationary forces that can improve the price of an asset. Once such example is the increase in technological advancements that increase efficiency and improve the profitability of a company. Remember that what drives the price of a stock in the long run is simply the growth in profits.

What the evidence tells us is that while we may all have different preferences on who we prefer to see in office, this historically doesn’t change much in terms of the stock market. Markets continue to grow regardless of policy positions.

A simpler way to think about this is that no matter who is in the office, the business community will figure out a way to make money. Whether you have the most restrictive regulatory policies, or the most laissez-faire economic policies, Amazon will figure out a way to deliver a package to your front door and make a profit in doing so. And if they can no longer do so, someone else will. In a more business friendly policy environment where demand increases for their products, they will hire people and expand to new locations in order to achieve their target profit growth. In a less friendly business environment where demand decreases, they will lay off workers and cut costs if necessary to get to their target profit growth. Either way, they will grow profits or be replaced.

The business community simply wants to know the rules, so they know how the game will be played. This is why markets love political gridlock. The more the rules are known, the easier it is to set up a business strategy around them.