Economic and Market Forecasts: What are They Worth?

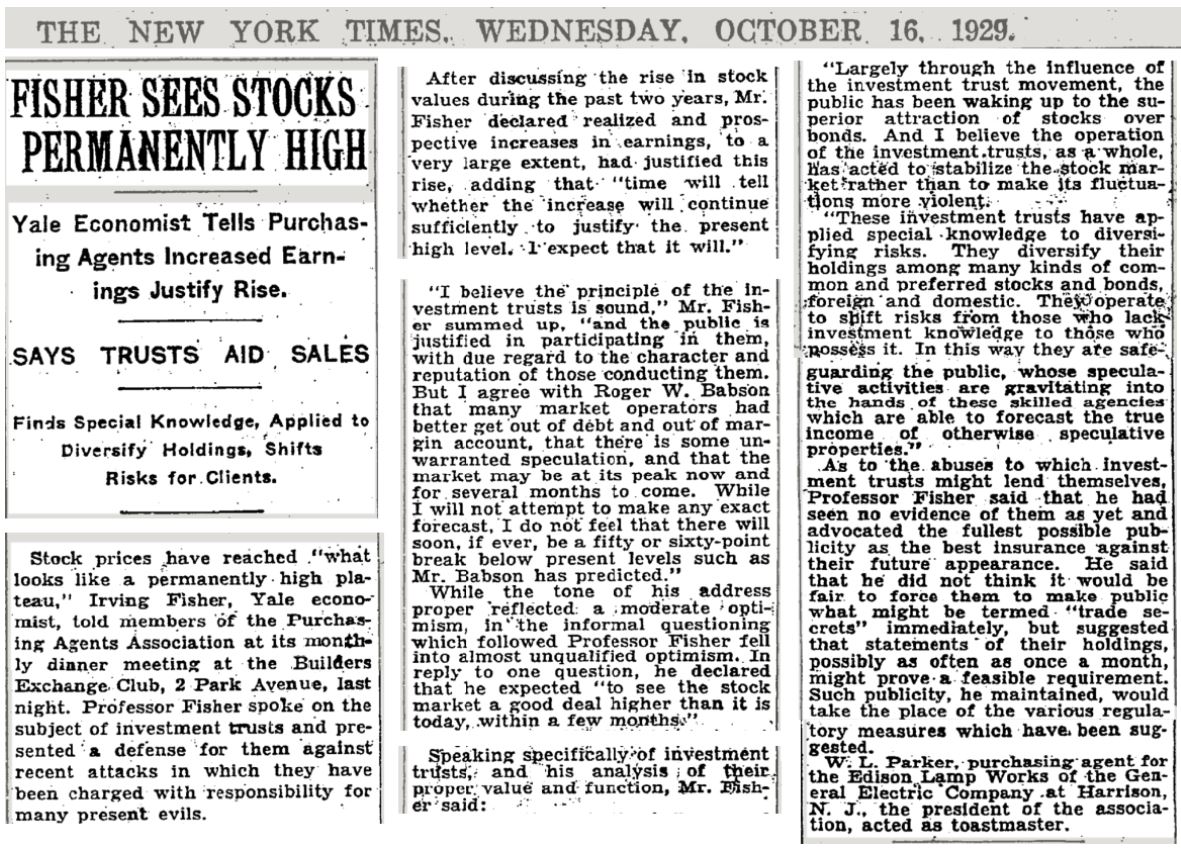

Yale economist Irving Fisher, October 15th 1929: “Stock prices have reached what looks like a permanently high plateau.”

A trip down memory lane looking at some of the economic predictions of the past can lead to a number of laughs, although not necessarily amusing to those who lived through the events that were so poorly predicted. However, what it really serves to do is remind us that there are few certainties in economics. As we have said in the past, markets are a massive financial eco-system with an ever-increasing set of shifting variables that make short-term predictions little more than an exercise in futility.

Unfortunately, Mr. Fisher’s comments in 1929 referenced in the NY Times article above is not alone in his failed predictions. The number of dramatically inaccurate predictions by economists, market guru’s and CEO’s would be endless. Here are just a few of the more astounding ones.

Dr. Ben Bernanke, (Federal Reserve Chairman) January 10th 2008: “The Federal Reserve is currently not forecasting a recession.”

Dr. David Lereah (US economist), August 12th 2005: “I truly believe the housing market will continue to expand. But rather than the double-digit price appreciation we’ve seen, we might see that drop to a 5 or 6 percent appreciation sometime toward the end of next year.”

Franklin Raines (CEO of Fannie Mae), 10th June 2004: “These subprime assets are so riskless that their capital for holding them should be under 2 percent.”

Dr. Paul Krugman (US Economist) September 29th, 1996: “By 2005, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s”

Dr. Paul Samuleson (First American Nobel Laurette in Economics) 1961: “the Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive.”

Jim Kramer (Market Guru) March 11th 2008: “NO! NO! NO! Bear Stearns is fine. Don’t move your money from Bear, that’s just being silly.”

As we can see, there is no shortage of terrible predictions that didn’t age well. In fairness, some of the same people have made some predictions that have come true. Or in some cases, positive or negative predictions turned out to be correct, but the prognosticator was simply early in their prediction. And some prognosticators on economic and market forecasts have better track records than others. But none are 100% successful.

What this demonstrates more than anything is the acknowledgement that economic predictions are difficult, and short-term market forecasts are impossible to do with any consistency. What makes market forecasting even more difficult is the fact that the markets and the economy are not one in the same. Economics has an impact on financial markets without question. However, as we often like to say, the market and the economy are often thought of as siblings, when in fact they are more like cousins.

As a financial advisor, the reason we suggest clients look at investing from a longer-term perspective that is built around asset allocation is the clear evidence that all asset classes will appreciate if given enough time. But predicting when, and how much within a specific period is next to impossible. The very concept of asset allocation means to own numerous asset classes that don’t necessarily always go up or down simultaneously as a means to balance and mitigate risk.

Essentially, you are saying that you know enough to know, that you just don’t know. If and when someone says something is definitely going to happen, be skeptical. The masses are often wrong, and the supposed “experts” are frequently wrong.