Delaware Statutory Trust 101: How They Work

The home purchase is one of the biggest investments the average American will make. Real estate can be expensive and comes with carrying costs to maintain a property. However, many real estate investors over the years have invested in secondary properties for either personal use, such as a vacation home, or solely as an investment property. In many cases, these investors have seen significant price appreciation in these properties. When it comes to selling a piece of real estate, the tax code is different between your primary residence and a secondary property.

Primary Residence

When selling your home, the calculation as to whether or not you owe taxes is based on the capital gain, after you exclude the first $250,000 per person ($500,000 for a couple). Imagine you paid $200,000 some years ago for your home, and yet today it sells for $1,000,000. In order to determine your tax liability, you first need to figure out what you spent on the home in capital improvements, such as new windows, new roof, new driveway, or kitchen and bathroom renovations. These are common examples of what homeowners spend money on to improve and maintain their home. Those costs get added to the original purchase price, and then you have an additional $250,000 per person exemption. As an example, the tax calculation for a married couple would look like this:

$200,000 – Purchase price

+$200,000 – Possible capital improvements

+$500,000 – Exclusion for a joint filer

=$900,000 – Total amount excluded from capital gains tax.

If the property sells for $1,000,000 – $900,000 exemption = a taxable amount of $100,000 subject to capital gains.

Secondary Property

When selling a property that is not your primary residence, you can still add in your capital improvements to the cost, However, there is no $250,000/$500,000 exemption. One of the other ways to reduce the cost is by applying capital losses against your real estate gains. As an example, if you lost money on a stock trade, that loss can reduce the amount of gain on the sale dollar for dollar. But what can you do if you don’t have any capital losses to use, and you still have a big taxable gain on the sale of the property?

Under the tax code there is an option known as a 1031 exchange that permits the transfer of one property into another property via a qualified intermediary without realizing a capital gain and continuing to defer the tax liability. The timing of the exchange is a challenge, as an investor has only 45 days to identify the next property and 180 days to close on the new property. Unfortunately, the IRS rules on direct 1031 exchanges have become more stringent and difficult to execute in a timely manner.

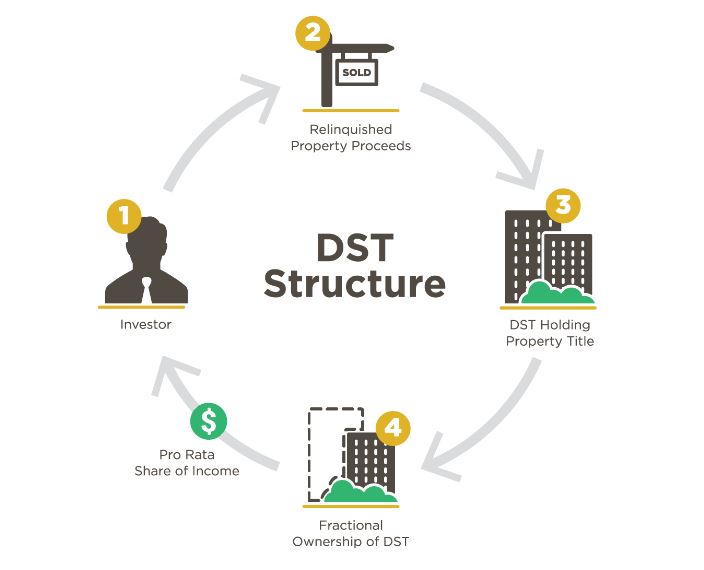

One of the other options is something called a Delaware Statutory Trust (DST). The DST was created in the late 1980’s as a special business trust to create a legally secure and clearly defined trust entity that establishes legal separation between the trust and its beneficiaries. Since the DST is a separate legal entity from its beneficiaries, creditors cannot seize or possess any assets held under trust.

DSTs are typically formed by real estate companies called sponsors, who purchase real estate assets that are placed under trust using their own funds. The DST sponsors then engage a registered broker-dealer to offer fractional shares of the trust, and individual investors purchase fractional shares of the DST. This process is another form of a 1031 exchange. However, as the individual investor, you are not required to seek out one or more properties on your own, as they are already part of what is typically a diversified real estate portfolio.

A DST may hold a series of properties related to commercial office buildings, multifamily apartment complexes, retail centers, industrial facilities, self-storage facilities, data centers or even medical facilities.

Once assets have been exchanged into the DST the investor has successfully deferred the tax liability on the gain and will now receive an income from the DST monthly that is typically in the area of 5%-9%. This income is representative of the investors’ proportionate share of the cash flow generated by the properties held in the DST after expenses. The capital gain is deferred until the investor chooses to sell the DST position, at which time they would incur the gain, as well as any gain on the property held in the DST. If the investor passes away while still invested in the DST, the assets receive the traditional step-up in basis, as with most other investments, and their heirs pay no taxes on the gains.

DSTs do not file a tax return as a trust, so as a result the investor receives their annual income at ordinary income tax rates as opposed to trust tax rates, which are less favorable.

The major benefits of the DST are:

Tax deferral

Cash flow

Instant real estate diversification

Passive approach to real estate investing

The potential drawbacks of the DST are:

There is limited liquidity

The real estate in the trust can still decline in value

Minimum investment to access

A DST may be a good option for investors sitting in a sizeable real estate position with significant capital gains. If you are concerned with generating a cash flow from the sale, don’t want to pay the taxes, and have no need for liquidity from the principal, a DST can be a possible option.

It’s important to understand that a DST is managed much like any other private Real Estate Investment Trust. As a result, it’s important to have a reputable sponsor with a successful track record of selecting and managing properties.