Inherited IRA Beneficiary Rules Clarified

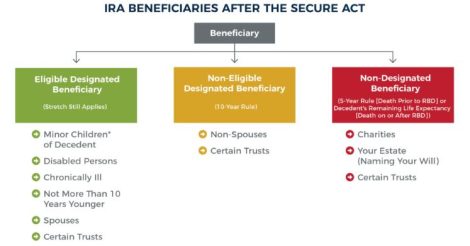

After many years of confusion, the IRS has finally clarified the rules around Inherited IRA’s. Under the old rules when a non-spouse inherited an IRA, the beneficiary was required to take a distribution every year based upon their life expectancy. As a result of the SECURE ACT 1.0, which took effect in 2020, several rules … Continue reading Inherited IRA Beneficiary Rules Clarified