2023 Tax & Retirement Plans Update

Every year or two since 2001, there are annual increases to IRA contributions that are adjusted due to inflation. However, IRA contributions are not the only thing that is adjusted for inflation. Many components in the tax code are adjusted that can impact various aspects of retirement planning.

Some of the important new limits and phaseouts are as follows:

RETIREMENT PLANS

IRA & ROTH IRA-contribution limits are increased to a maximum of $6,500 ($7,500 if over age 50).

The deductibility phaseout for IRA contributions for those with a retirement plan at work should increase for singles to $73,000-$83,000 in 2023, and for those married filing jointly to $117,000-$137,000 in 2023.

The direct contribution limit phaseout will increase to $138,000-$153,000 in 2023 and for those married filing jointly to $218,000-$228,000 in 2023. If your Modified Adjusted Gross Income-MAGI is above that, you’ll need to contribute indirectly via the backdoor conversion process if eligible. Some info regarding backdoor conversions can be found here:

https://landmarkwealthmgmt.com/back-door-conversions-a-tax-free-growth-opportunity/

SEP IRA-contribution limits will increase to $66,000 per year for 2023.

SIMPLE IRA & 401k-contribution limits will increase to $15,500 in 2023.(Employees over age 50 are entitled to an additional $3,500 catchup contribution).

401k & 403b–EMPLOYEE contributions will increase to $22,500 in 2023 ($30,000 if over age 50).

401k & 403b–TOTAL contribution limits with EMPLOYER matching will increase to $66,000 ($73,500 if over age 50).

457-contributions will increase to $22,500 in 2023. (457 plans can have unique catch-up contribution rules, so consult with your plan administrator about your plans limits).

401(a)-the compensation limit (the amount of earned income that can be used to calculate retirement account contributions) will increase to $330,000 in 2023.

(This is typically 5X the maximum 401(k) plan total contribution limit).

Defined Benefit Plans-415(b) limit for maximum annuity limit will increase to $265,000 in 2023. (The highly compensated employee definition will increase to $150,000 in 2023).

Some other important changes are:

Flexible Savings Accounts-FSA contribution limits will increase to $3,050 in 2023.

Health Savings Account-HSA’s for single people, the contribution limit will increase to $3,850 in 2023. Family coverage will increase to $7,750.

Social Security-benefits will also increase by 8.7% for 2023. The maximum possible Social Security benefit for someone taking benefits at age 70 for the first time will be $4,559 per month.

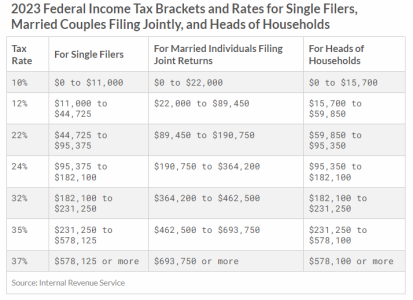

Additionally, the IRS updated the 2023 income tax thresholds to adjust for the impact of inflation. A breakdown on the marginal tax rates are as follows:

These are just a few important retirement planning and tax updates. It’s also important to note that other aspects of the tax code can and will change as well. That can include things such as the child tax credit and various other items that may have a substantial impact on you. It’s important to consult with both your financial advisor as well as your tax advisor to see how these changes may impact you.